This week, Sam Bankman Fried is found guilty on seven counts of fraud, OpenSea cuts half of its employees and CEO announces new direction for the company, and Coinbase realized a net loss of $2.3mm in Q3 2023 vs. $545mm in Q3 2022.

let’s jump right in 👇

🌞 Review of Modular Capital’s Braintrust Thesis

💫 Artemis Data Insights:

SocialFi User Retention

RabbitX Price vs. Trading Volume - Follow-up

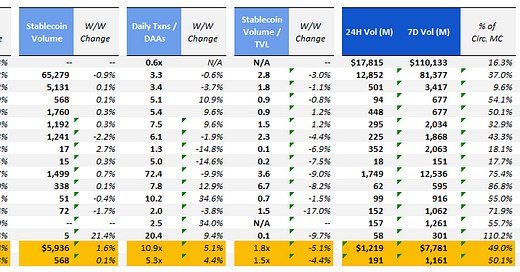

The crypto ecosystem saw continued momentum upwards as L1 / L2 market prices realized average and median WoW increases of 13.1% and 9.7%, respectively. This week saw a number of Alt L1s skyrocket as OSMO and SOL saw ~58% and ~25% WoW price increases, respectively. OSMO was buoyed by its announcement of Pipette, a new feature that allows for bilateral liquidity between Celestia rollups and the Cosmos ecosystem. Meanwhile, SOL ran up into the annual Solana Breakpoint Conference in Amsterdam. Meanwhile, the S&P 500 and Nasdaq Index saw the best trading week of the year with the S&P 500 up 6% and NASDAQ up 7% on the back of Fed messaging that rate hikes might be done.

🌞 Review of Modular Capital’s Braintrust Thesis

This week, Modular Capital, a crypto investment firm focused on in-depth, thesis-driven research, published a comprehensive analysis of Braintrust, a decentralized talent network operating within the burgeoning web3 space. Today, we dive into their paper to understand the core drivers behind their investment thesis.

For more information on Modular Capital, check out Artemis’ fourth edition of Analyst of the Month, which highlights the stories of Modular Capital’s Co-Founders James Ho and Vincent Jow.

Braintrust Overview:

Braintrust stands at the forefront of the web3 talent marketplace, connecting an expansive network of freelancers to a client roster featuring heavyweights like Goldman Sachs and Nike. Braintrust has raised over $120 million in funding from both crypto funds (Multicoin, Variant, Galaxy Digital, Pantera) and traditional tech hedge funds and venture funds (Tiger Global, Coatue).

Despite a challenging economic landscape, Braintrust's GSV has remained resilient, underpinned by a talent pool surge, primarily driven by tech industry layoffs. The platform's recent initiative, a self-service option for small to medium businesses, has seen a tenfold increase in customer and job postings, showcasing its ability to adapt and thrive.

Braintust also recently introduced the “Professional Network” in July 2023, a web3 social networking platform similar to LinkedIn. Although still in its beta phase, the platform has garnered between 6-11K active monthly users, and with Braintrust’s installed based of ~490k talent profiles, the platform could potentially scale above other leading Web3 social platforms (Lens, Farcaster) that have actively monthly users in the range of 10-50k

Braintrust Business Model / Monetization:

Braintrust's business model and monetization strategy are designed to disrupt the traditional staffing and consulting firm industry by offering a more efficient and cost-effective solution. Unlike legacy firms that can take weeks to vet and staff the right candidates and charge markups ranging from 20% to 75%, Braintrust leverages an extensive network of established candidates to vet within less than 48 hours and fill positions in approximately two weeks. This speed is enabled by Braintrust's open and distributed platform.

The company's competitive edge is further sharpened by its pricing model. Braintrust charges a 15% markup on customer spend, a recent increase from 10% as of July 2023. This fee is imposed on the clients, while the talent side incurs zero fees. This model not only makes Braintrust's services up to 5 times cheaper compared to traditional firms but also simplifies the payment process for clients, who can use conventional payment methods like ACH, wire transfers, credit cards, and billing platforms such as Bill.com.

The markup Braintrust collects, which equates to a 13% take rate on gross service value (GSV), is utilized for token buybacks in the open market. This strategy is designed to return value to the network's stakeholders, including many individuals who contributed to the platform's growth by recruiting companies and talent.

Per Modular Capital, Braintrust's gross service value (GSV) stands at $90M as of Q3 2023, with a market cap hovering around $100M. Their revenue model, anchored by a 15% service markup, is bolstered by a robust $45M cash position and a capital allocation policy of reinvesting all net revenue into buying back BTRST tokens.

Valuation Scenarios & Core Assumptions

Modular Capital’s Base Scenario assumes that Braintrust can grow to a market cap of ~$1.5bn from its current FDV of ~$100mm. This takes into account the following operating assumptions:

Braintrust penetrates 1% of the US software developer TAM of $250B, which translates to $2.5B of GSV. For context, RHI has penetrated 6% of the US Accounting TAM of $120B. Modular Capital then assumes that Braintrust can take its take rate up from 13% to 20%, which is still lower than that of its peers (RHI and Upwork gross margins of 43% and 40%, respectively). This outcome generates a net revenue of $500mm for Braintrust, which Modular Capital believes should trade at a 3x revenue multiple, similar to that of peer group, resulting in a market value of $1.5bn for Braintrust’s core business.

For the Professional Network (Web3 LinkedIn product), Modular Capital assumes that the platform’s user base will grow to ~15mm users (1-2% of LinkedIn’s 900mm users) and would monetize at $15 / user, similar to the user monetization rate of LinkedIn. This would result in ~$200mm of revenue, which at a 5x valuation multiple would result in $1bn of market value. With that said, Modular Capital includes a 25% probability weighting to that outcome given the unproven nature of the product and only assigns $250mm of potential market value to the Professional Network segment

Together, the total market cap in Modular Capital’s base case is ~$1.7bn, a 17x multiple on its current trading value of $100mm.

Risks and Mitigants:

Modular also provides an analysis of key risks to their thesis playing out.

Resilience Amidst Recession Concerns: While a major recession poses a risk to Braintrust's business, the company has already weathered a "tech recession," with many enterprise clients implementing hiring freezes and the tech industry laying off around 400,000 workers. Staffing and consultancy firms often face cuts during economic downturns, but Braintrust may have already felt the bulk of this impact.

Token Supply and Vesting Dynamics: Early token purchasers have completed vesting, contributing to past sell pressure. However, with approximately 85% of tokens in circulation and 15% still vesting, the remaining sell pressure is expected to ease. Braintrust is actively buying back tokens, countering sell pressure, and aiming to create additional token utility within the Professional Network. The current market cap appears undervalued, particularly when considering the alignment of the $45M market cap with the cash on the balance sheet and the community rewards pool growth outpacing its drain.

What do you think about Braintrust? Tell us in the comments below and be sure to check out the full piece here!

💫 Artemis Data Insights: SocialFi User Retention

Over the past months, we’ve seen the onset of SocialFi (social finance) platforms that allow users to trade “keys” or “shares” of other users on the platform which provide access to exclusive chat channels and enable users to take part in value appreciation of the keys of other users on the platform. During this time, a few protocols have emerged - friend.tech (the original protocol that created this model, built on Base), Stars Arena (a similar protocol to friend.tech built on Avalanche) and Post Tech (a friend.tech copy built on Arbitrum) are among the leading SocialFi protocols today.

As the first mover in the space, friend.tech has continued to see the highest number of daily active users at ~5.3k as of November 2023 (peak of ~73.8k on October 15, 2023). Meanwhile, while Post Tech and Stars Arena both saw strong growth numbers at launch (peak of 22.7k and 11.4k for Post Tech and Stars Arena, respectively), both have seen usage dwindle over the past few months (daily active user figures of ~540 and ~840 in November 2023 for Post Tech and Stars Arena, respectively).

Ultimately, all of these protocols have seen usage level off since they initially launched, raising questions about sustainability of the SocialFi concept. It remains to be seen whether the protocols can continue to build and improve retention over a longer period of time.

💫 Artemis Data Insights: RabbitX Price vs. Trading Volume - Follow-up

Last week’s article provided a look into how perp trading volumes followed Bitcoin price movement upwards, and how RabbitX saw its price spike after trading volumes sharply rose. This week, we wanted to evaluate whether those trends persisted.

This week it appears that perp trading volumes are on track to decline WoW while BTC prices continued to inch upwards.

Meanwhile, the more interesting observation is that while RabbitX trading volumes came down heavily after spiking mid last week, the token price has stabilized over the past few days at its new elevated price of ~$0.05. This price relationship over the past few days appears to indicate that other factors beyond trading volume are playing into the price of the token.

Detailed dashboard for people who love more numbers in smaller font:

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism (source: Token Terminal). Weekly commits and weekly dev activity as of 10/23/23.

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments.