This week, Tether invested in Quantoz and introduced new MiCA-compliant Euro and USD stablecoins (Tether), while Paxos acquired Membrane Finance to issue MiCA-compliant stablecoins in the EU (Paxos); FIFA to launch new blockchain based game, FIFA Rivals, in collaboration with Mythical Games (FIFA); Suntory Group, makers of famous Yamazaki Whiskey, announces tokenization of premium malt beer for collectors (Avalanche).

🌞 Solana Smashes Through All-Time Highs in Fees

💫 Starknet Announces Important Upgrade

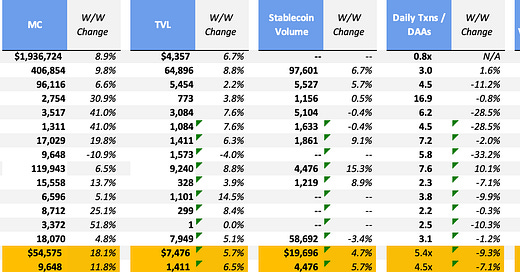

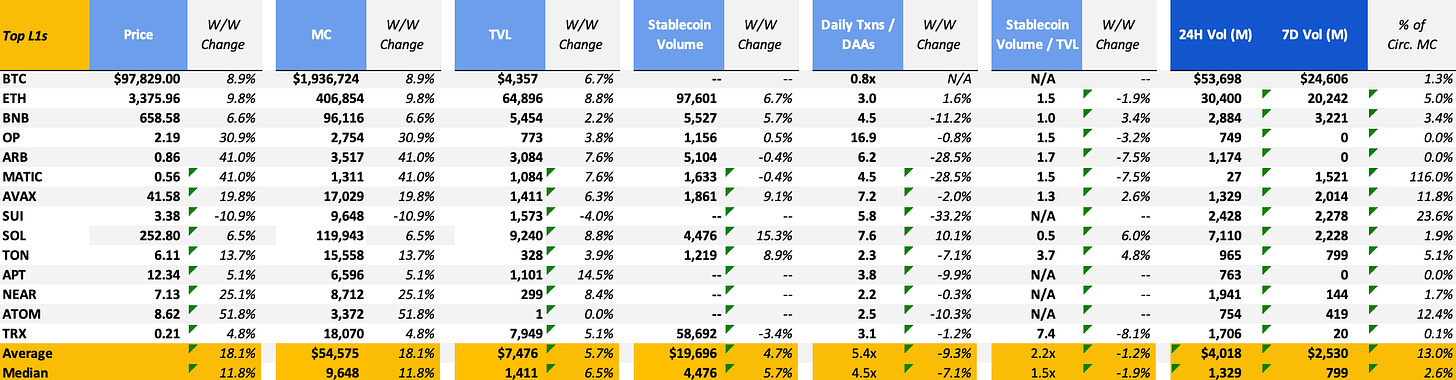

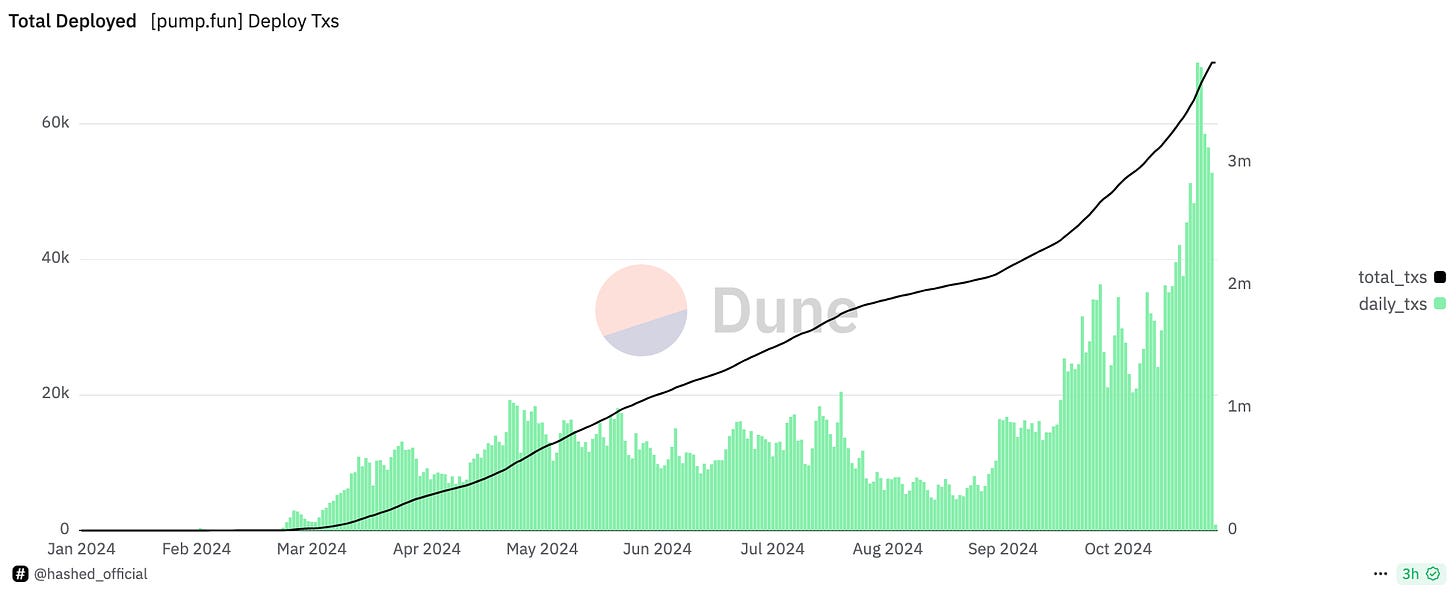

Markets continued to see a surge in prices this week, extending their post-election rally. BTC and SOL were notable winners this week. BTC continued to make all-time highs as it battled to break the $100,000 milestone. SOL also made all-time highs last week, breaching $260 per SOL for the first time ever. As these major assets make all time highs, it has come as a surprise to many that ETH remains ~30% off its 2021 highs. Some attribute this to the parasitic nature of Layer 2 rollups, as well as the Ethereum ecosystem’s failure to capture the memecoin market now dominated by Solana. Altcoins largely performed well this week, despite many continuing to be far from all time highs (ARB 60% off all time highs, AVAX 70%, NEAR 65%).

In positive news from Washington DC, Gary Gensler, the Chair of the U.S. Securities and Exchange Commission (SEC), has announced his resignation effective January 20, 2025, coinciding with President-elect Donald Trump's inauguration (SEC). This development carries significant implications for financial regulation, particularly concerning the digital asset sector. Chair Gensler was largely damaging to the growth of the blockchain and digital asset industry (see Operation Choke Point 2.0). The industry now speculates eagerly as to the successor will be. On the tails of the resignation announcement, four Solana ETF applications were filed with the SEC on behalf of Bitwise, VanEck, 21Shares, and Canary Capital (ETF.com).

Further positive news for the industry came from DC as Trump nominated pro-crypto hedge fund manager Scott Bessent for Treasury Secretary (CoinDesk). This nomination requires approval by the Senate before becoming official.

Also of note, Michael Saylor’s MicroStrategy ($MSTR) entered the top 100 US publicly traded companies as BTC moved higher (Fortune). MSTR has outperformed BTC this year, and is up 515% YTD. The firm that is notoriously long BTC announced another $2.6bn debt offering last Wednesday (MicroStrategy). Citron Research, famed for short selling fraudulent or overhyped companies, announced they were selling MSTR short, causing the stock to tumble.

🌞 Solana Smashes Through All-Time Highs in Fees

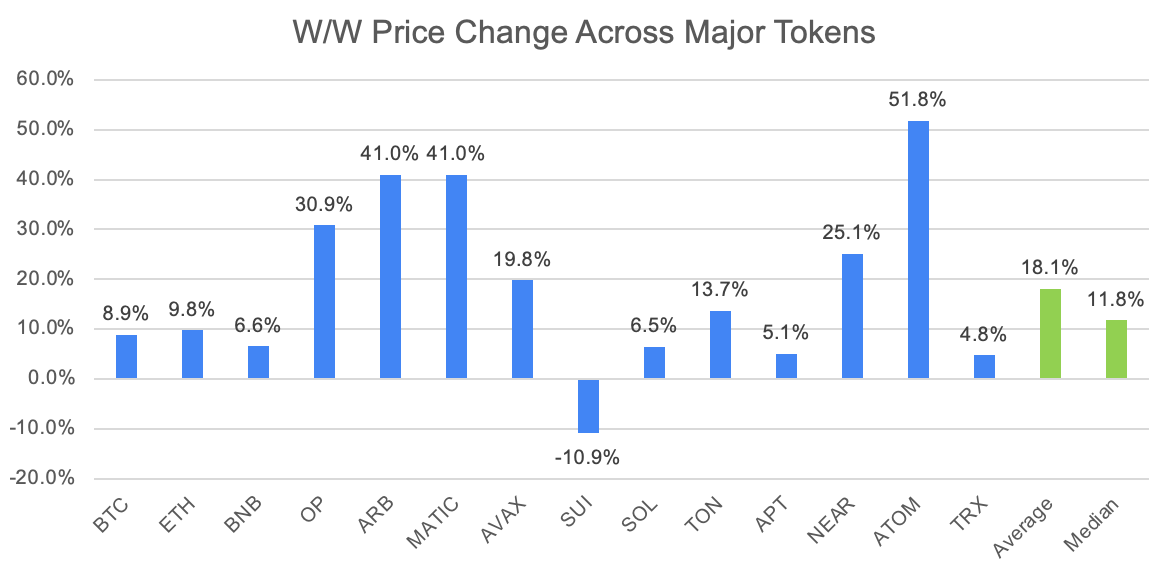

Solana has been one of the greatest beneficiaries of the recent bull market as investors have flocked to memecoin investing. Apps like Moonshot that make it easy to buy and sell memecoins, including onramping with Apple Pay, have helped onboard curious investors. There has been a massive proliferation in number of tokens minted on pump.fun, the primary memcoin launch platform, surpassing 40k per day every day in the past week.

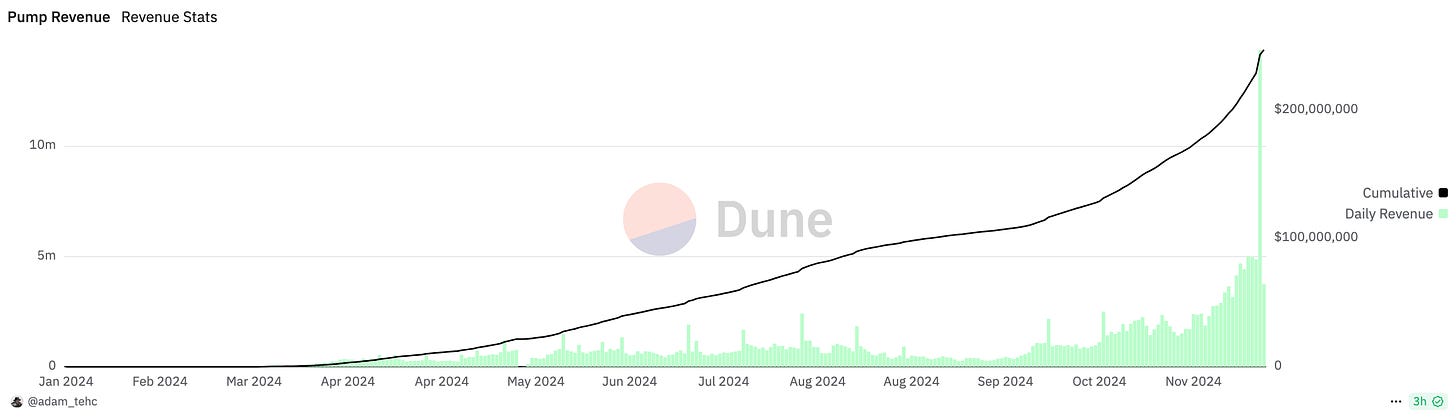

In fact, the platform has seen such success this year that it is rapidly approaching $250m in revenue for 2024, having generated $100m in the past month alone. Given the current rate of growth, it would not be surprising to see the platform surpass $300m in revenue for the year.

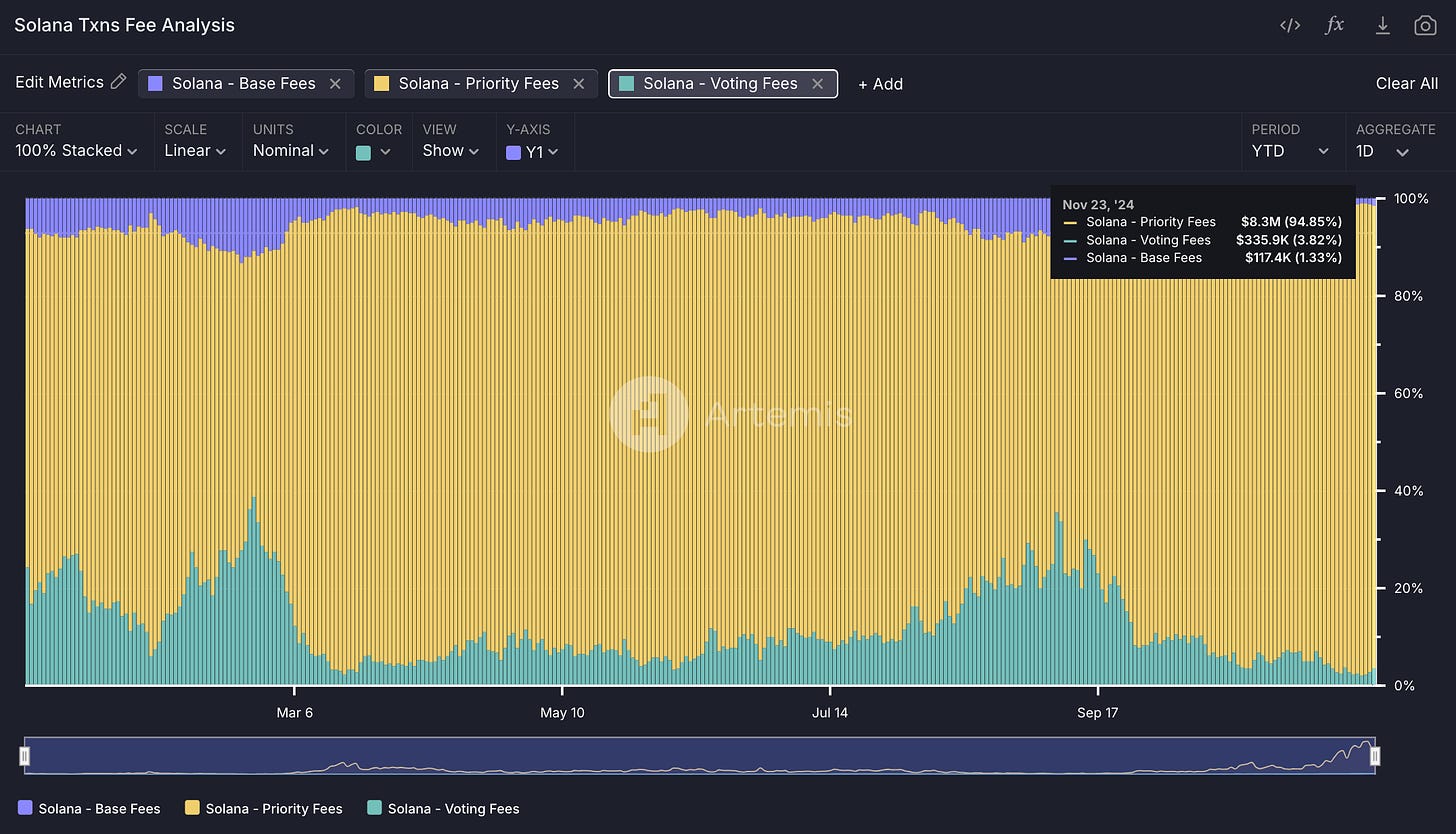

This rise in activity has reflected itself on the Solana protocol as the network has seen an accompanying surge in fees to all time highs. Last week, the network generated nearly $70m in transaction fees (base fees + priority fees). Half of those fees are currently returned to tokenholders via burns, resulting in ~$35m in revenue to SOL token holders the week of Nov 18th.

Of note, in May 2024 the Solana community voted to implement SIMD-0096, an upgrade to the Solana network that would result in 100% of priority fees accruing to validators. While this change has not yet been activated on mainnet, we can expect there to be a dramatic shift in tokenomics since 95% of revenue to SOL holders via burns come from priority fees once it is implemented.

Another beneficiary of increased activity on Solana is Jito. The Solana MEV infrastructure provider has generated $73m in MEV rewards in the past week, $4m more than Solana generated in priority fees, indicated an rise in MEV activity on Solana. A 5% Block Engine fee means Jito is generating north of $3m in weekly revenue at current activity levels.

The meteoric rise in Solana's ecosystem activity paints a compelling picture of the platform's evolution from a theoretical "Ethereum killer" to a genuine hub of retail crypto activity. While memecoin trading has been the primary catalyst, the resulting fee generation and tokenomics implications suggest a more sustainable future. The pending implementation of SIMD-0096 and Jito's substantial revenue streams indicate that Solana's infrastructure is maturing alongside its growing user base. However, the platform's dependence on memecoin trading raises important questions about long-term sustainability and whether this surge in activity will translate into lasting institutional and developer adoption. As the crypto market continues to evolve, Solana's ability to diversify its use cases while maintaining its current momentum will be crucial to its continued success.

💫 Starknet Announces Important Upgrade

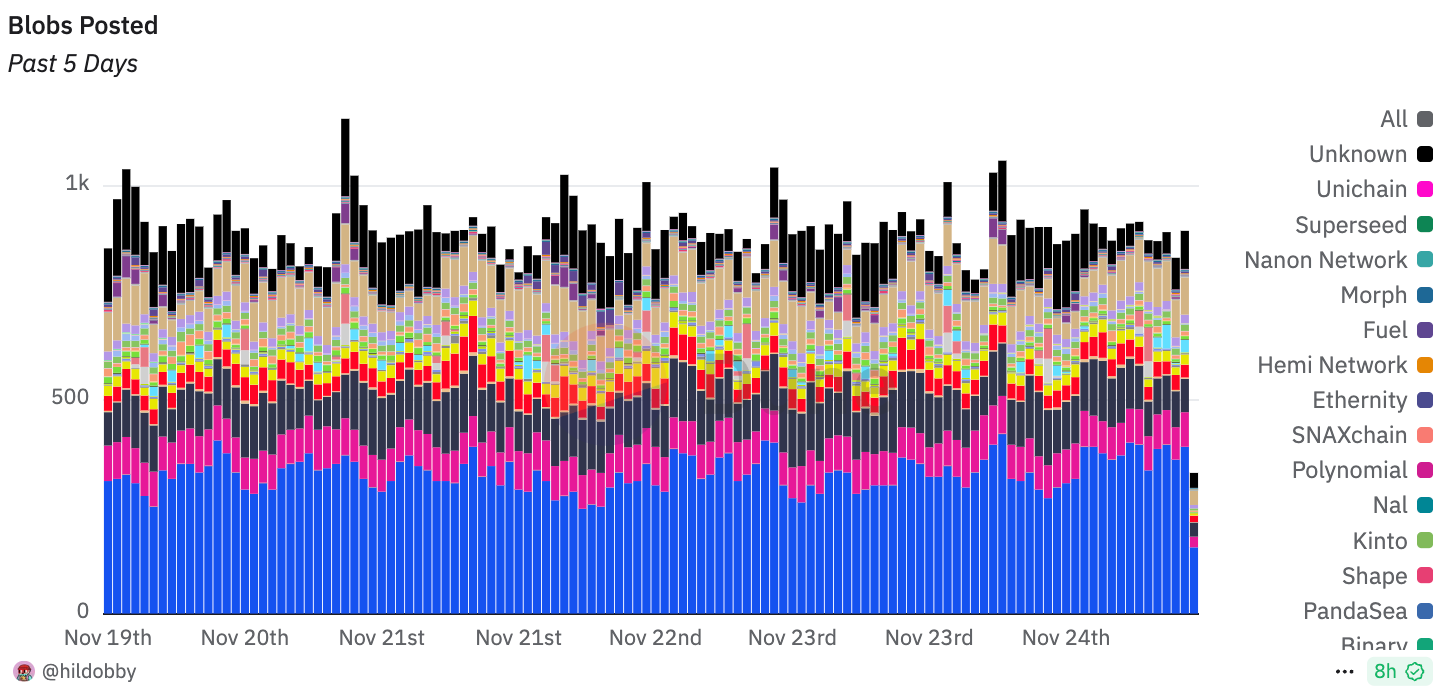

Starknet is one of Ethereum’s foremost ZK rollups - differentiating itself from optimistic rollups through its use of ZK-proofs instead of fraud proofs for transaction verification. Starknet's latest upgrade, version v0.13.3, marks a significant advancement in the use of blobs, or binary large objects. This upgrade is crucial as it addresses the increasing demand for efficient data handling on Layer 2 rollups by reducing blob gas costs by five times. Blobs are the name given to the dedicated data storage space used by Layer 2 rollups to post their data to the Layer 1. The growing demand for usage on Layer 2s has naturally led to higher costs associated with blob usage, necessitating innovative solutions to manage these expenses.

In general, blob usage on Ethereum has been a critical component of its scaling strategy. Rollups like Starknet, Arbitrum, and others have been significant consumers of blob capacity.

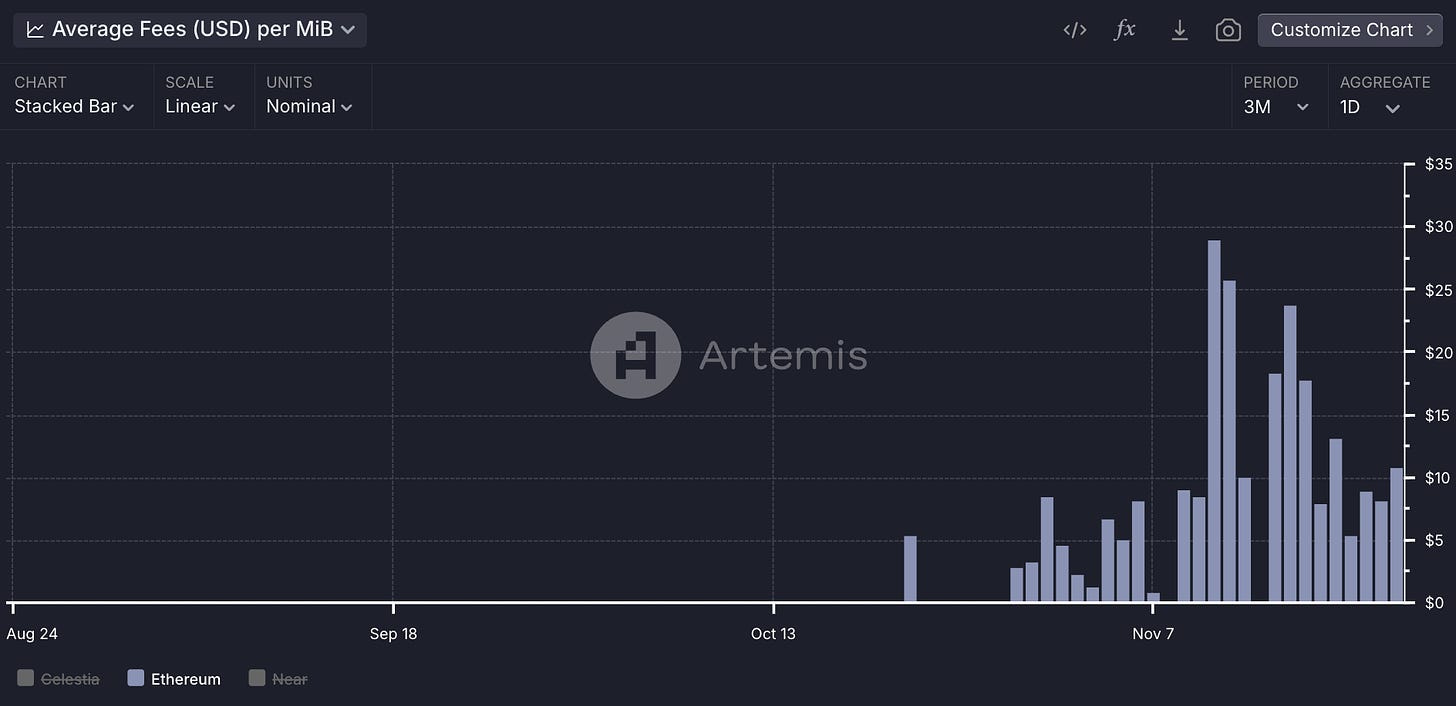

Blobs have a fixed size and are ephemeral, being pruned from most Ethereum nodes after roughly two weeks. Blob fees have historically been very low since the implementation of blobs in EIP4844 as they have their own fee market which has largely not seen price discovery. Recently, as onchain activity has begun to spike, demand for blobspace on the L1 has increased, and the blob fee market has entered price discovery. While blob fees per MiB were historically near zero, more recently the cost per MiB on Ethereum has reached as high as $30.

This highlights the importance of efficient blob usage and cost management in maintaining the economic viability of rollups and supporting Ethereum's scalability. Starknet's v0.13.3 upgrade is particularly important as it introduces two key innovations: state-diff compression and transaction squashing. These techniques significantly reduce the amount of data sent to Layer 1 by compressing state differences and combining multiple transactions into fewer blocks. This not only lowers costs but also ensures that users are charged based on their actual data contribution, promoting fairness and efficiency. By reducing blob gas costs, Starknet enhances its competitiveness as a Layer 2 solution, aligning with Ethereum's broader goals of increasing blob capacity and improving data efficiency across rollups. This upgrade is a step towards more sustainable and scalable blockchain operations, benefiting both developers and end-users by lowering transaction fees and improving network performance.

Liquid Token + Crypto VC Roles

See below for job postings from friends of Artemis! Feel free to reach out directly to us if you’re interested in applying / learning more about the roles!

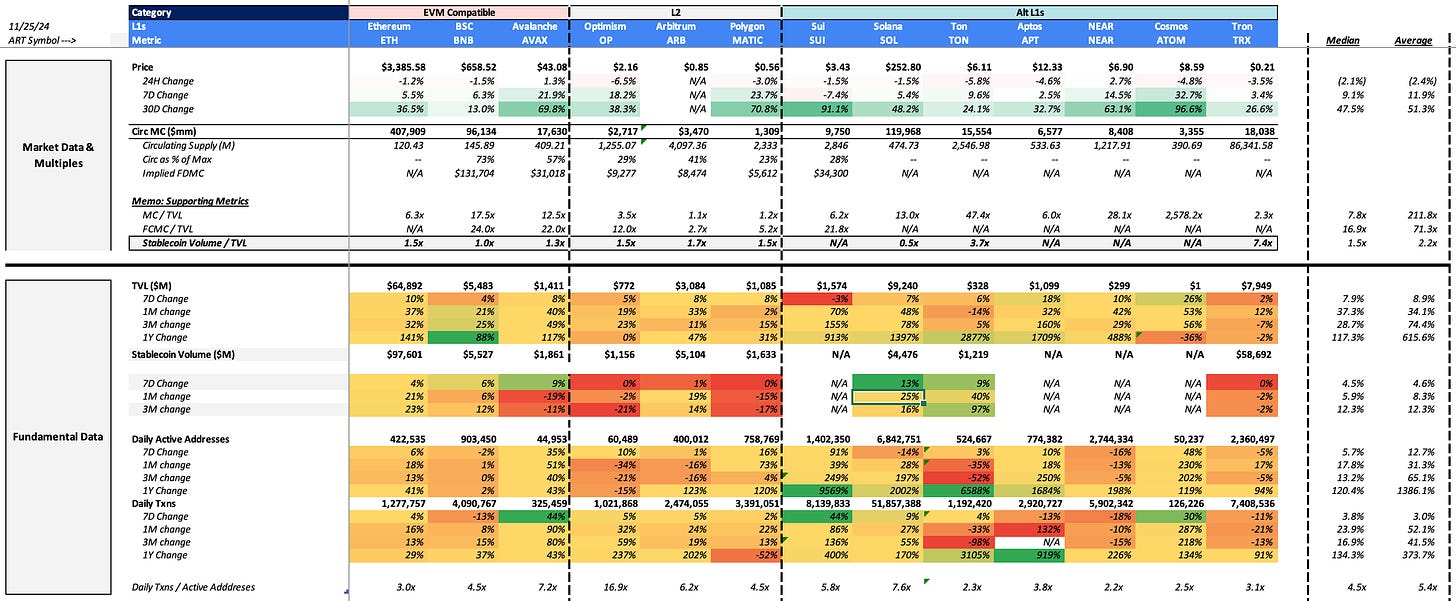

Detailed dashboard for people who love more numbers in smaller font:

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism.

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments.

Artemis Sheets

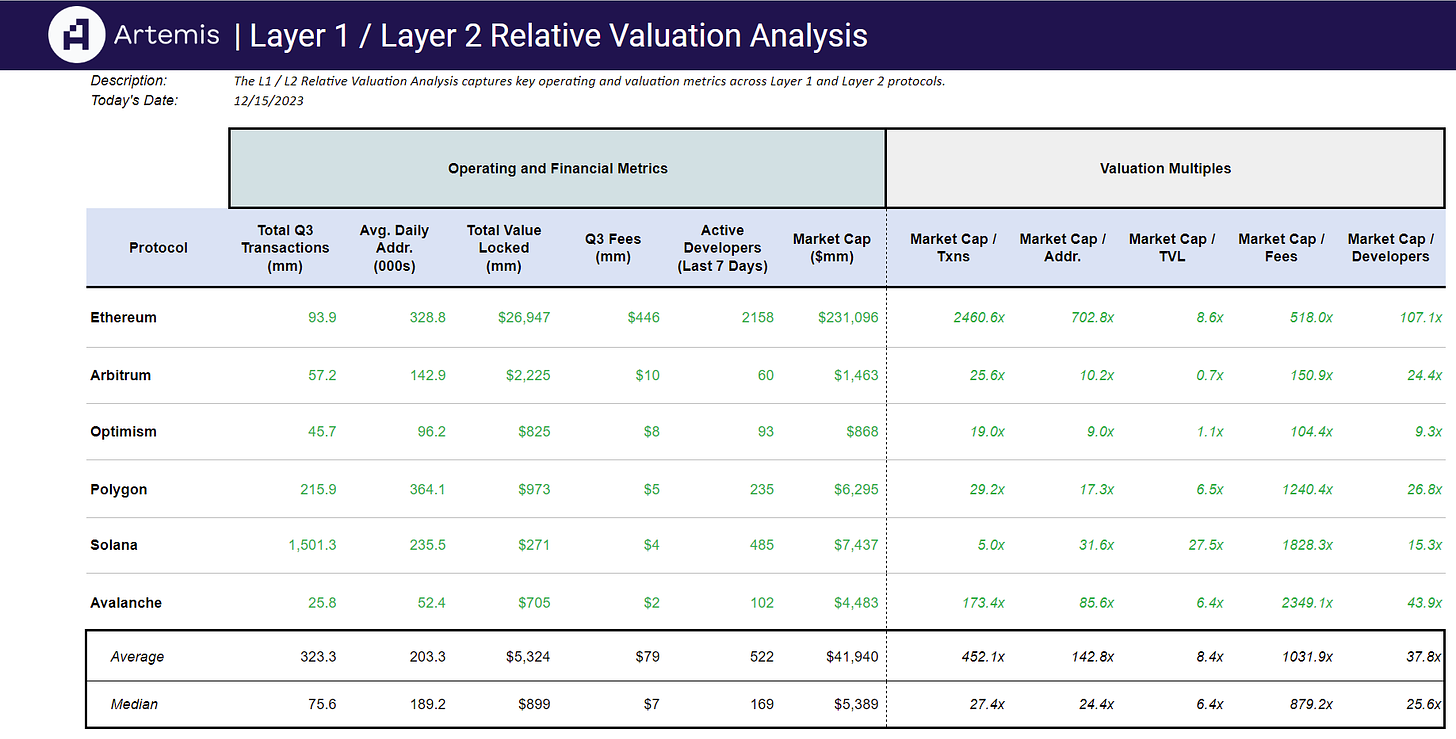

Check out other analyses such as the Artemis Relative Valuation L1 / L2 Analysis in Google Sheets here! Track valuation multiples across key operating metrics for top blockchain including Ethereum, Arbitrum, Optimism and Solana.

Powered by Artemis Sheets 🌞

ARB my wishlist