Last week, Tether unveils platform for asset tokenization targeted at businesses and nation states (CoinDesk); Trump announces the creation of the Department of Government Efficiencty (DOGE) which will be helmed by Elon Musk and Vivek Ramaswamy (CNN); Coinbase lists major memecoins including PEPE and WIF as memecoins outperform (Yahoo Finance); the FBI raids the home of Polymarket CEO Shane Coplan, seizing his phone (NBC News).

🌞 The Future of Ethereum: Beam Chain

💫 A Deep Dive into DeSci

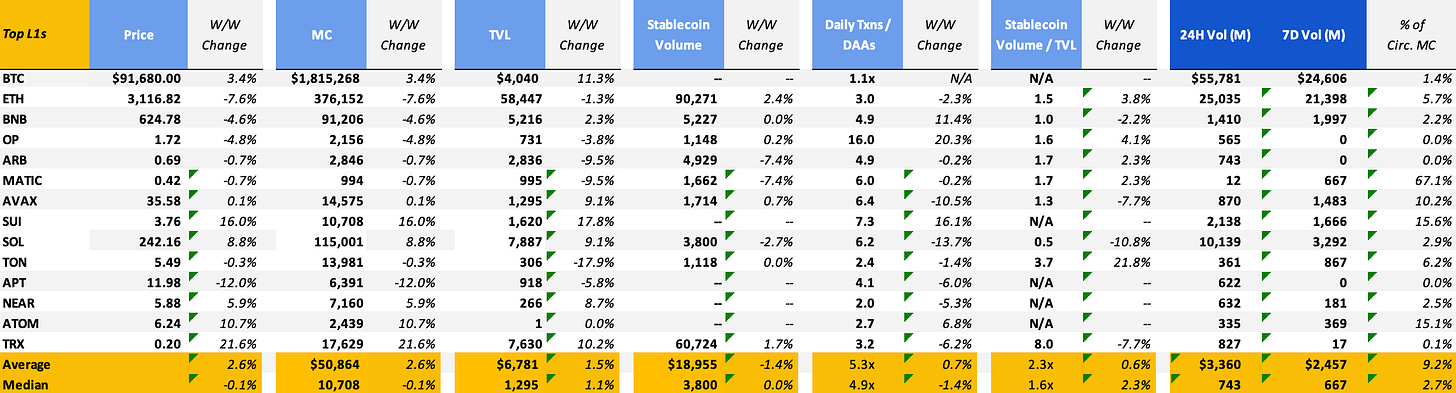

Last week saw mixed performances for crypto assets. Following post election gains, some assets saw a reversion back to the mean, while other lagging assets caught up to the market. Notable gains include TRX (+21.6%), SUI (+16.0%), and ATOM (+10.7%), while APT (-12.0%) and ETH (-7.6%) recorded significant losses. The average price change across all tokens is a positive 2.6%, though the median change is slightly negative at -0.1%, suggesting a few outliers skewed the average upwards.

In institutional news, BlackRock announced their decision to expand the BUIDL tokenized money market fund beyond Ethereum. They said they will be bringing the fund to Aptos, Arbitrum, Avalanche, Optimism and Polygon. Notably, Solana was excluded from the mix, while competing L1 Aptos was included, signaling a big win for the Aptos ecosystem in terms of institutional adoption. This comes as a big hit to Ethereum which had previously started gaining a moat in the RWA space as the only chain that BlackRock had deployed on.

Broadly, markets saw a downturn last week. Despite markets pricing in a further rate cut in December, Fed Chair Jerome Powell signaled no rush to do so, citing strong economic growth, a solid job market, and inflation still above 2%. He noted inflation is steadily heading toward the target, allowing a gradual shift to neutral monetary policy, keeping borrowing costs elevated for now (Reuters). In equities, the S&P 500 made record highs early in the week. However, it ended the week down 2.30% amid the Fed’s hawkish comments. The top 6 most valuable US companies lost nearly a half a trillion in market cap on Friday (Forbes).

🌞 The Future of Ethereum: Beam Chain

At this year’s DevCon, held in Bangkok, one presentation stood out from among the rest. Justin Drake, a leading researcher at the Ethereum Foundation, proposed his vision for the future of the Ethereum consensus layer. As a reminder, after the Merge in September 2022, Ethereum has been split into two separate, yet coupled, software layers. One of these handles transactions and is known as the executional layer. The other one deals with achieving agreement on the true state of the network and is known as the consensus layer.

Justin Drake proposed the creation of the Beam Chain, an upgraded version of the Beacon Chain, Ethereum’s current consensus layer. Justin points to the fact that the specs for the Beacon chain were finalized fiver years ago, and that since then, much has changed. Some of the proposed improvements to the consensus layer include reducing the slot time from the current 12 seconds to 4 seconds, implementation of faster finality such as single slot finality, and the implementation of ZK Snarks at the consensus layer.

The announcement was met with backlash on social media. Prominent figures in the blockchain industry called out the seemingly long timeline that was proposed (Beam Chain is estimated to be finished by 2029).

This brings to light one of the tradeoffs made by Ethereum in decentralization. Ethereum is one of the largest and most decentralized protocols in terms of its development. This leads to potentially longer developments cycles, but also a lack of leadership in terms of the direction and priorities for development. This has been one of Ethereum’s main criticisms in recent times: if developers are not aligned on the future direction of the chain, it will fall behind competitors that have a more clear vision.

💫 A Look Into the Rising Vertical of DeSci

Over the past week, a new genre of tokens have started to take significant mindshare: DeSci. The idea of decentralized science, or DeSci, has been around for many years as a concept for incentivizing novel scientific research. This time, a new platform called pump.science is combining the virality of memecoins on Solana, with science to incentivize longevity experiments.

“The vision of pump.science is to create a protocol for financing, researching, and developing chemicals that increase healthspan, the time a person (or any organism) can live with high physical and cognitive function” (pump.science docs).

Pump.science works by allowing users to bet on which compound and experiment will increase an animal’s lifespan. For example, today, on the pump.science site there are two compounds being tested on flies: Rifampicin and Urolithin A.

By clicking into one, you’ll be able to see the experiment in action. In the screenshot below, flies in one tube have been given the compound, while in the other they have not (the control group). The objective is to see whether or not the compound will extend the lifespan of the test group in comparison the control group.

While the experiment is currently being done on flies, the goal is to advance the project to test the compound on larger animals. Here is where the intersection with crypto comes in. At the beginning of the experiment, the developer of the compound creates a token, known as an IP token, on pump.fun. If the experiment is a success (ie. it extends the lifespan of the test animals), and the market capitalization of the IP token exceeds some threshold amount, the experiment will advance to the next stage. The token is sold in order to pay for each subsequent experiment.

Some important things to note about an IP token:

IP token holders can participate in key decisions related to the development, management, and licensing of the intellectual property

An IP token does not entitle its holder to any economic benefits or contractual right to receive any proceeds following the sale of an IP-NFT or its IP.

IP token holders may also receive access to exclusive research information as well as preferential access to innovations, collaborations, or future opportunities related to the IP

It's up to the IP owner whether the IPT holders get paid if the IP gets commercialized

Pump.science is a product developed by Molecule, a decentralized biotech protocol that is a Solana Foundation grant recipient. Binance Labs also recently announced an investment into a DeSci protocol BIO Protocol. As investment into the space continues to accelerate, it will be interesting to see what will come of this. Will new drugs be discovered that otherwise would not have?

Liquid Token + Crypto VC Roles

See below for job postings from friends of Artemis! Feel free to reach out directly to us if you’re interested in applying / learning more about the roles!

Detailed dashboard for people who love more numbers in smaller font:

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism.

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments.

Artemis Sheets

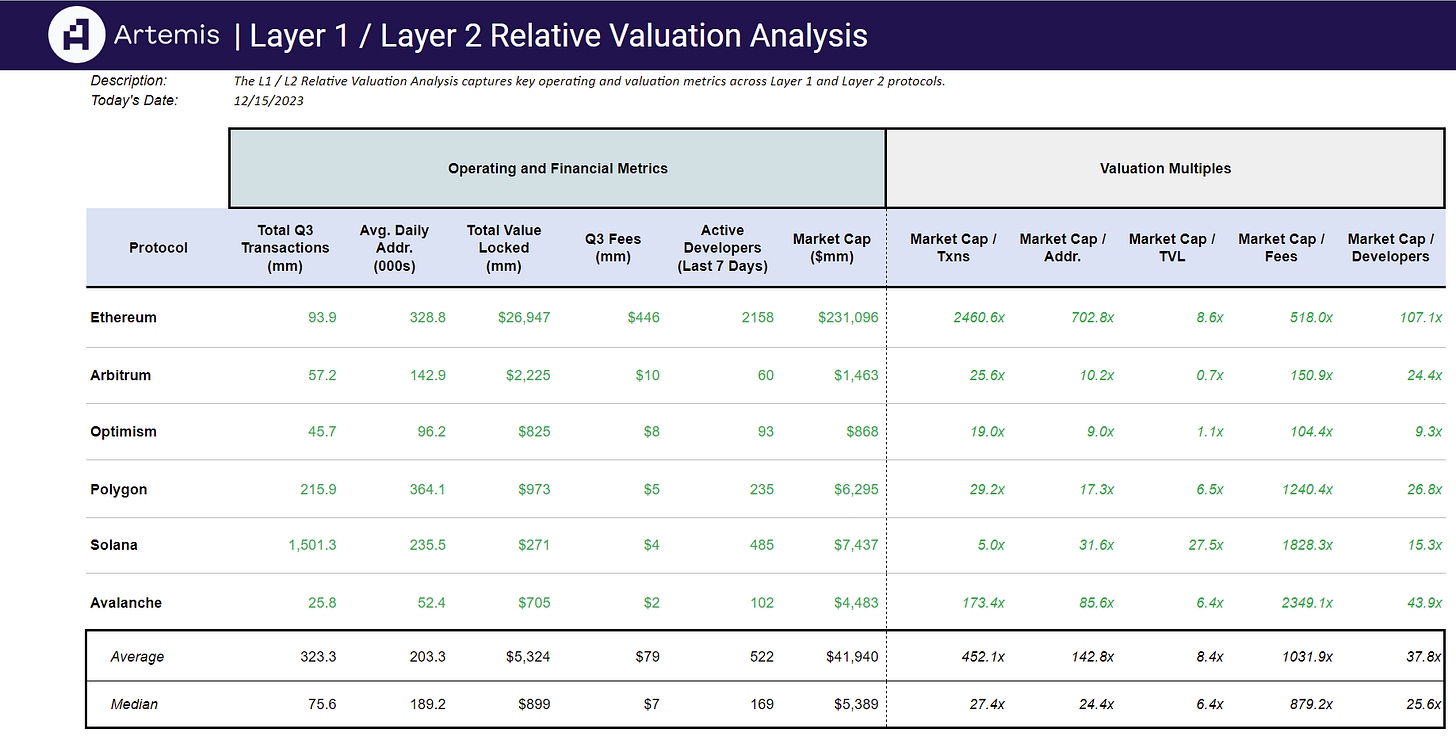

Check out other analyses such as the Artemis Relative Valuation L1 / L2 Analysis in Google Sheets here! Track valuation multiples across key operating metrics for top blockchain including Ethereum, Arbitrum, Optimism and Solana.

Powered by Artemis Sheets 🌞