Last week, Donald Trump won the United States presidential election, as the GOP sweeps the Senate and House; Polymarket calls the elections hours before mainstream media (CNBC); Bitcoin makes all time highs (Coingecko); Samurai Shodown, classic fighter game, to launch on Sui (Blockworks).

🌞 Highly anticipated Eclipse layer 2 launches, bringing Solana to Ethereum

💫 Ethereum Name Service (ENS) announces “namechain” layer 2

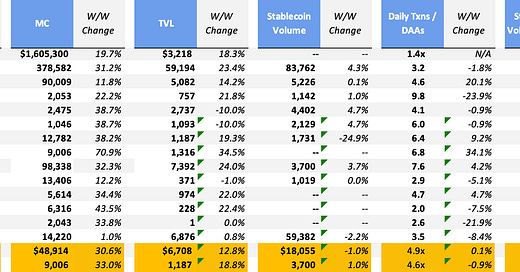

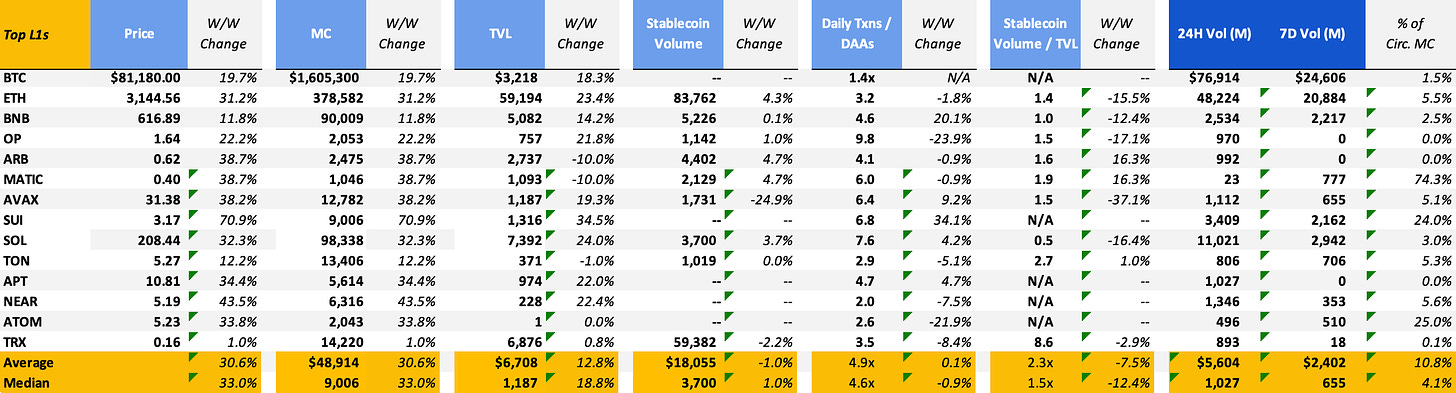

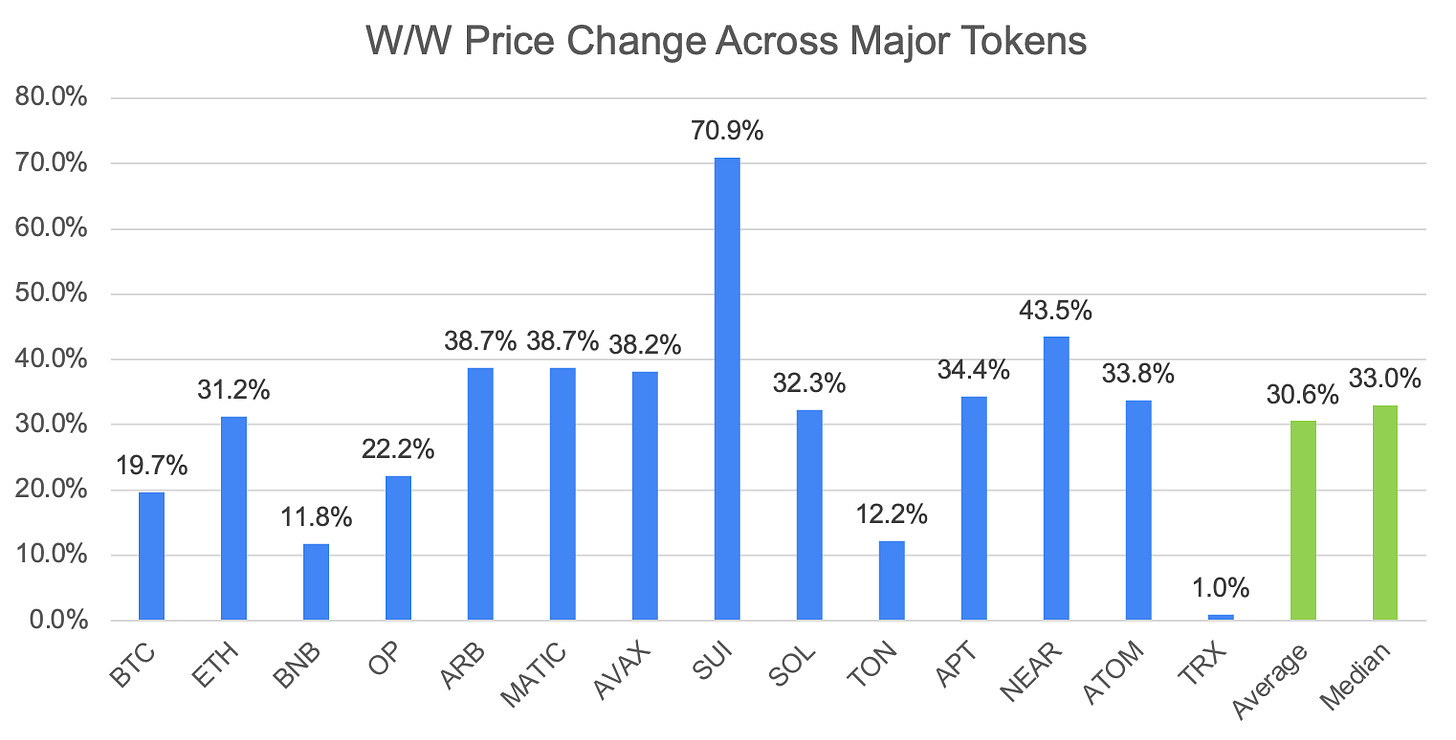

This week saw major uncertainty removed from the market. Donald Trump’s election win has ushered in a new era of excitement and optimism in the crypto market, particularly for Bitcoin, which catapulted past $80,000 shortly after his victory. Assets across the board saw large gains with the select assets exhibiting an average return of 30% over the past week. The reality of a pro crypto governement that may pass favorable legislation has excited the market.

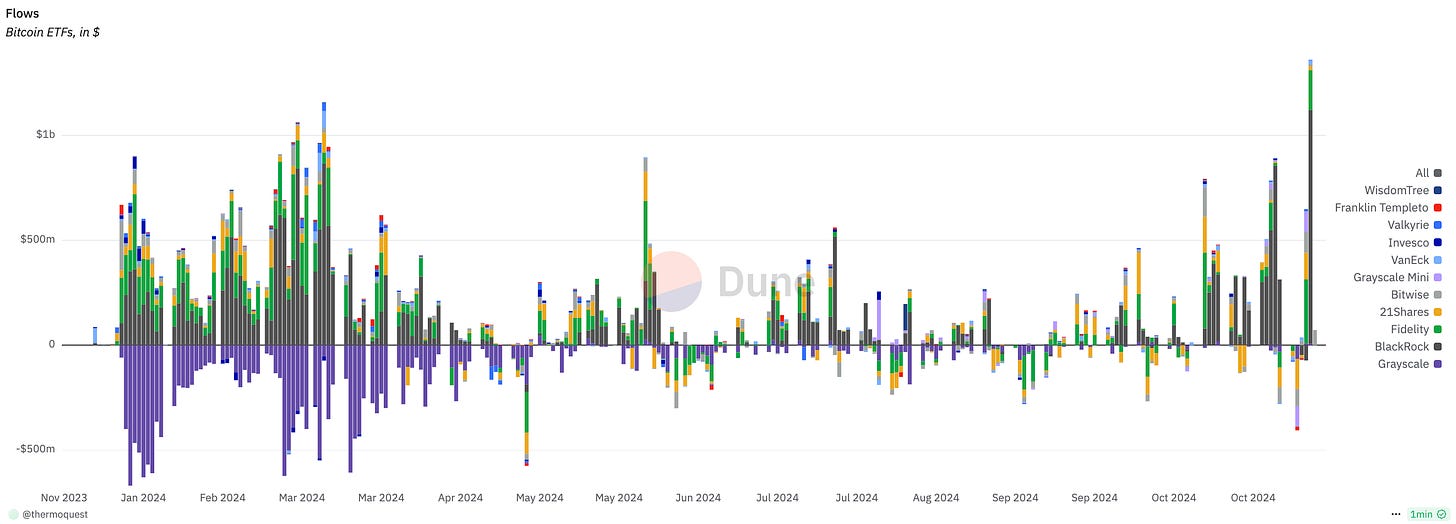

President elect Donald Trump has pledged to make the U.S. a leader in digital assets, and with an administration stacked with crypto advocates, from VP-elect J.D. Vance to crypto-friendly policy advisors, the landscape looks promising for a much-needed regulatory shift. This optimism was reflected not just in Bitcoin’s price rally but in the record inflows into Bitcoin ETFs, with investors piling in on expectations of a more favorable environment for digital assets.

But it’s not just Trump’s election that’s powering this surge. The Federal Reserve’s recent 25-basis-point rate cut has provided additional fuel to risk assets, setting the stage for a potentially explosive growth phase in crypto. Lower interest rates make traditional investments like bonds less attractive, pushing investors toward high-growth assets—such as Bitcoin and other cryptocurrencies—that can offer a hedge against inflation. The Fed’s dovish stance, combined with expectations for more crypto-friendly policies from Trump’s administration, has brought Bitcoin back into the spotlight as a store of value and speculative asset.

Together, these events could catalyze a wave of institutional participation, and we may see banks revisiting crypto custody and stablecoin issuance, which have been stifled by regulatory headwinds (see SAB 121). Trump’s pro-crypto platform, particularly with expected SEC leadership changes, may allow traditional finance to interact more freely with public blockchain networks. This environment is creating tailwinds that could support digital assets as they break into the mainstream, and Bitcoin’s recent surge past $80K may be just the beginning.

🌞 Highly anticipated Eclipse layer 2 launches, bringing the SVM to Ethereum

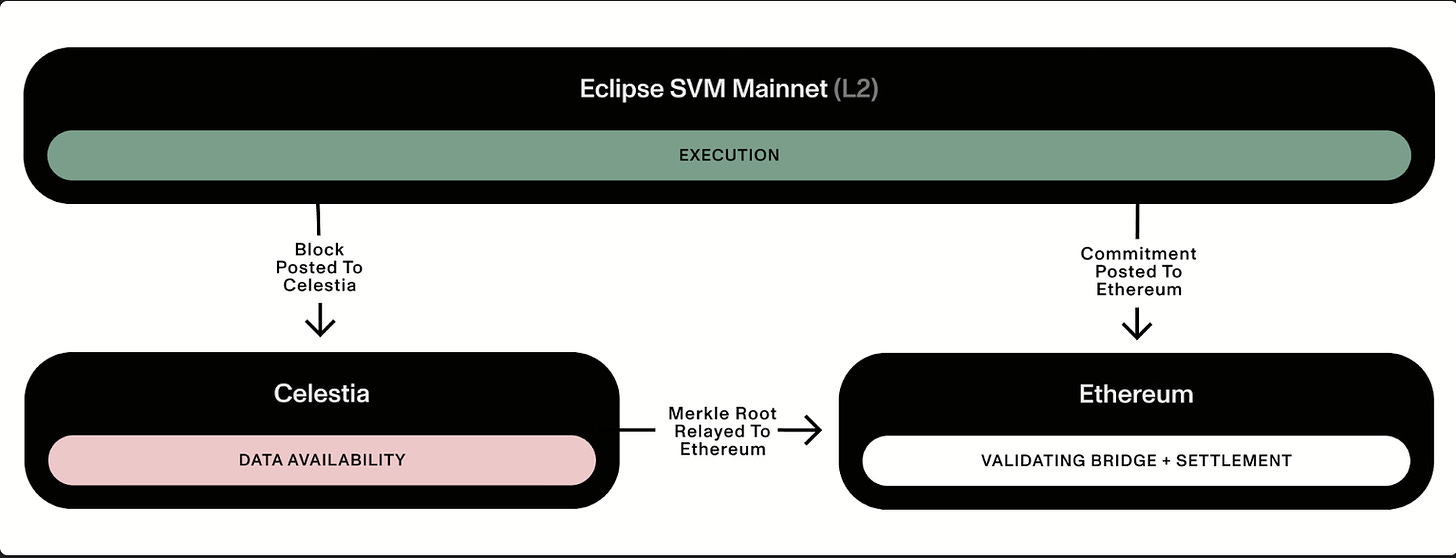

The launch of Eclipse’s Solana layer-2 network is a powerful development in the world of rollups. Eclipse, built on the Solana Virtual Machine (SVM), allows Ethereum users to benefit from Solana’s speed and lower fees without compromising on Ethereum’s security. This approach is unique because it blends Solana's scalability with Ethereum’s established infrastructure, aiming to make it easier and cheaper for developers to build decentralized applications that work seamlessly across both ecosystems.

Eclipse’s architecture uses Solana’s fast and cost-effective SVM at the execution layer to process transactions and manage state changes. This setup enables Ethereum-level security while leveraging Solana's processing speed, offering a solution for Ethereum developers facing high gas fees. The SVM allows for multi-threaded processing and parallel state access which provides faster transaction execution than the single-threaded, sequential state access of the EVM implemented in leading rollups like Arbitrum and Optimism.

In keeping with the modular thesis, Eclipse will decouple the data availability, choosing to use Celestia to fulfill this function. Eclipse cites Celestia’s higher blob size per block as a key driver for this decision (Ethereum provides an average of 0.375MB of blobspace per block compared to Celestia’s 2MB). Blob size per block is a limiting factor to transaction throughput as rollups’ transaction data is posted to data availability layers in blobs.

Eclipse has launched with a number of projects on it already.

tETH: introduced as the ‘Unified Restaking Token’, tETH allows users to deposit a liquid restaking token (such as eETH, ezETH, or other) on Ethereum, which will effectuate a minting of tETH on Ethereum, and a subsequent bridging to Eclipse via Hyperlane. Eclipse hopes to become a hub for LRTs via what they call an LRTfi ecosystem.

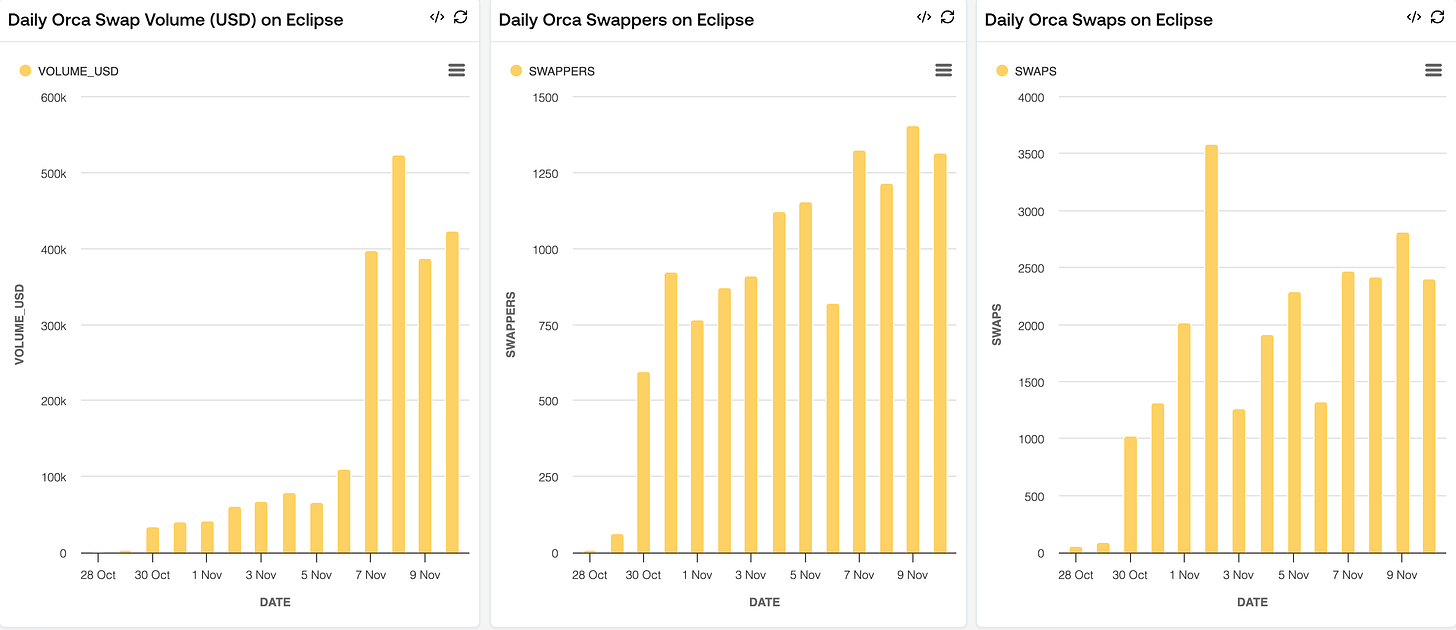

Orca: the 2nd largest DEX on Solana, is the first major exchange to launch on Eclipse. Since launch, Orca on Eclipse has seen +1000 swappers, generating ~500k USD in volume.

Eclipse brings an innovative solution to the Ethereum rollup ecosystem by integrating the Solana Virtual Machine. The ecosystem is still young and showing great promise as the Solana ecosystem continues to take mindshare.

💫 Ethereum Name Service (ENS) announces “namechain” layer 2

Ethereum Name Service (ENS) recently announced on Monday they are working on launching “namechain”, an Ethereum layer 2 specifically built to handle the operational needs of ENS. As background, ENS is a decentralized naming protocol built atop the Ethereum blockchain that transforms complex hexadecimal addresses into human-readable names. While it's often compared to DNS, ENS is fundamentally more powerful as it's designed for the decentralized web and blockchain ecosystems. For example, ENS names are also ERC-721 compliant tokens (NFTs), making them composable with the entire DeFi ecosystem. Names can be used as collateral, traded on NFT markets, integrated into DAOs, or used in novel financial instruments. A DNS name, being just an entry in a centralized database, can't participate in these programmable finance scenarios.

The system's capabilities extend far beyond simple address resolution. An ENS name can point to various resources including smart contract addresses across multiple chains, IPFS content hashes, website URLs, and arbitrary metadata. This makes it a versatile identity layer for Web3, allowing users to consolidate their digital presence under a single human-readable identifier.

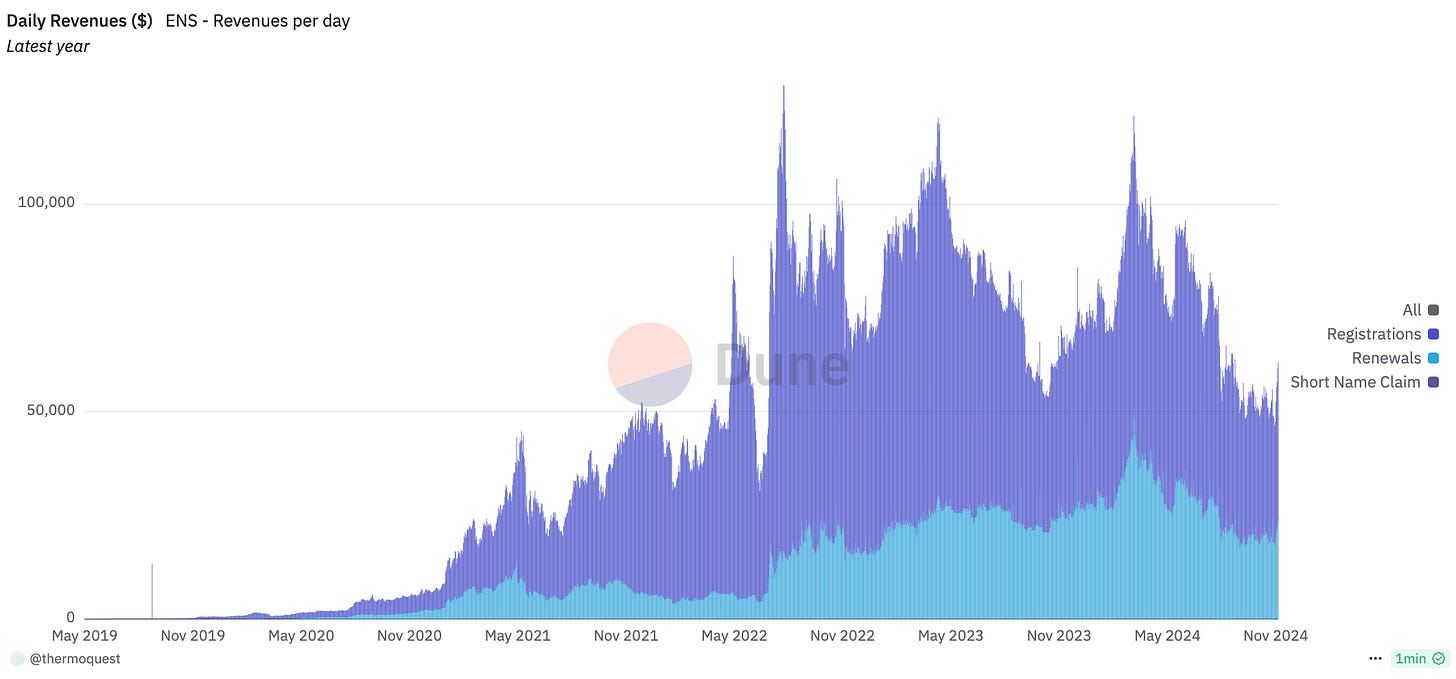

Governance of ENS is handled through a Decentralized Autonomous Organization (DAO), with holders of the $ENS token having voting rights on protocol decisions and parameter changes. The economic model includes annual registration fees, with premium pricing for shorter names, generating revenue that flows to the DAO treasury. According to data by Steakhouse Finance, the DAO generates the majority of its revenues from new name registrations, although about 35% of revenues come form renewed names.

What sets ENS apart is its extensibility and composability. Through standardized interfaces, any smart contract can interact with ENS, making it a foundational layer for decentralized applications. The system supports subdomains with independent management, allowing for complex hierarchical naming structures. This has made ENS an essential piece of Web3 infrastructure, serving as both an identity system and a naming protocol that other protocols and applications can build upon.

ENS’ announcement to move to an Ethereum layer 2 is an important move as Uniswap, the world’s largest DEX, announced Unichain just last month. We may start seeing more and more Ethereum applications decide to move to a custom built Layer 2 in order to lower costs, and have dedicated blockspace.

Liquid Token + Crypto VC Roles

See below for job postings from friends of Artemis! Feel free to reach out directly to us if you’re interested in applying / learning more about the roles!

Detailed dashboard for people who love more numbers in smaller font:

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism.

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments.

Artemis Sheets

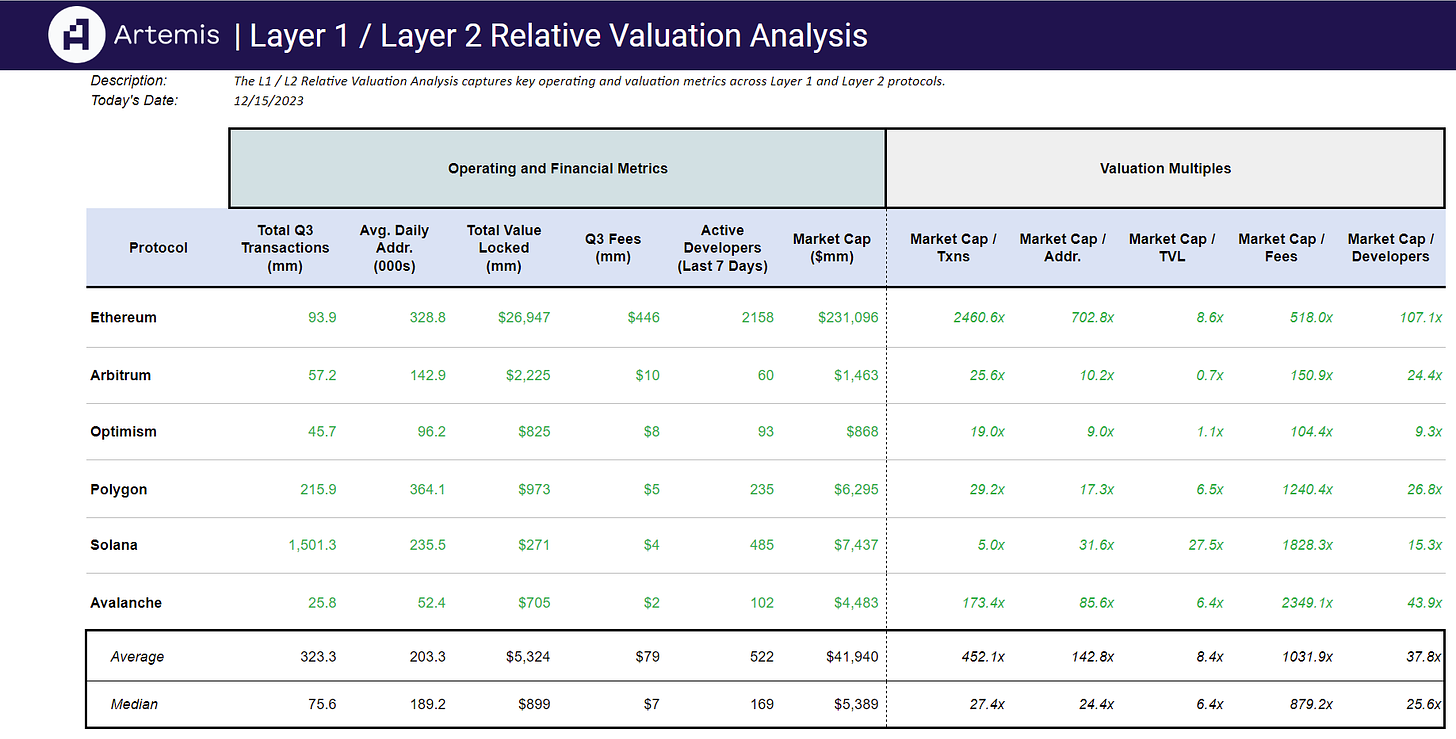

Check out other analyses such as the Artemis Relative Valuation L1 / L2 Analysis in Google Sheets here! Track valuation multiples across key operating metrics for top blockchain including Ethereum, Arbitrum, Optimism and Solana.

Powered by Artemis Sheets 🌞

So every major ETH based app will have its own L2?

How will they all interop between each other seamlessly? Just seems so counterintuitive from a user experience POV..