This week, Michael Saylor’s MicroStrategy is sitting on $1bn in unrealized BTC profits, BlackRock filed a document to list and trade shares of the iShares Ethereum Trust on NASDAQ, and Laser Digital announced an Ethereum fund that stakes its long-only Ethereum position to enhance returns in the fund.

let’s jump right in 👇

🌞 JPM institutes programmable payments for its native digital currency, JPM Coin

💫 Artemis Data Insights:

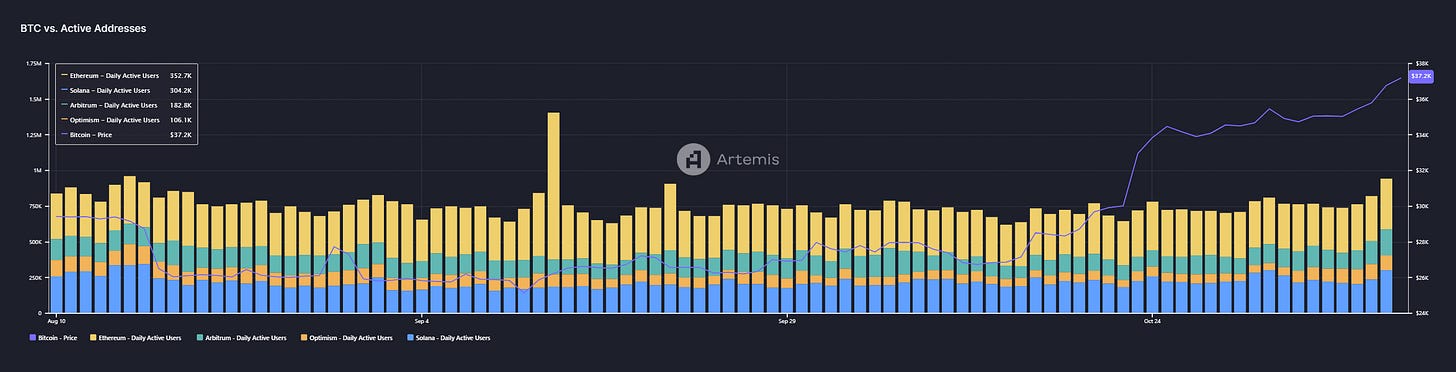

BTC Price vs. On-Chain Active Addresses

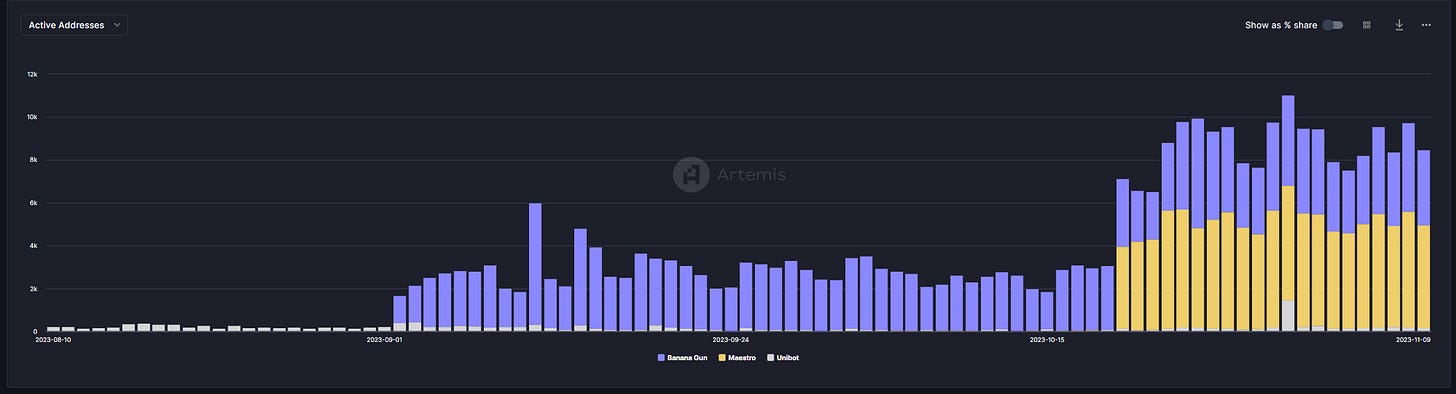

Telegram Bot User Growth (Banana Gun, Unibot, Maestro)

The crypto ecosystem continued to explode upwards as L1 / L2 market prices realized average and median WoW increases of 19.5% and 19.3%, respectively. This week’s price movement was led by BlackRock indicating its intent to list and trade shares of the iShares Ethereum Trust on NASDAQ and the SEC opening talks with Grayscale to convert the Grayscale BTC Trust into an ETF. The positive regulatory developments led to speculation that SOL would likely see similar treatment in the near future and resulted in the Grayscale SOL trust trading up to a ~600% premium to NAV as of Friday November 10, 2023, indicating meaningful institutional demand for the asset. Meanwhile, the S&P 500 and Nasdaq Index continued to push higher at 1.2% and 2.1%, respectively, despite more hawkish comments from Jay Powell.

🌞 JPM institutes programmable payments for its native digital currency, JPM Coin

Onyx by JP Morgan recently enabled programmable payments through its blockchain-based digital currency, “JPM Coin.” This feature allows clients to program their transactions using a smart-contract like interface, allowing for increased control and flexibility over their finances. The program enables automatic movement funds after providing a custom set of conditions such as funding a bank account in the case of shortfalls, or executing payments based on events such as “margin calls, delivery of goods or fulfilment of contractual obligations.”

As part of the launch, Naveen Mallela, head of the Coin Systems program at Onyx by J.P. Morgan stated that, “Programmability has been a key objective for digital currencies and tokenized money since the beginning. [JP Morgan’s] new offering makes payments programmable ushering in the era of dynamic and event driven infrastructure in the industry. This is an important milestone and foundational for real-time, automated and programmable treasury.”

Several companies have already started leveraging this technology. Siemens AG, a leading multinational conglomerate, was one of the first to employ these programmable payments, emphasizing the benefits of round-the-clock blockchain-based bank accounts and enhanced automation capabilities to support the automatic movement of money to fill potential account shortfalls. Other major corporations such as FedEx and CarGill are also expected to adopt the technology in the coming weeks. FedEx staff director of Global Cash Management Rebeca Wiadacz noted that FedEx recently went live with the Onyx / JPM Coin platform and is committed to leverage cutting edge solutions such as blockchain technology to fuel their future growth.

This move by J.P. Morgan is part of a larger trend among major financial institutions, such as HSBC and Goldman Sachs, who are increasingly incorporating blockchain into mainstream finance. These institutions are continuing to explore diverse applications of blockchain, from HSBC’s distributed ledger platform intended to expedite gold trading to BlackRock tokenized shares of its money market funds.

💫 Artemis Data Insights: BTC Price vs. On-Chain Active Addresses

While crypto prices have been moving upwards on ETF / regulatory news, we were curious to see if there have been meaningful changes in on-chain user activity. The short answer - a little bit, and only in the past few days (and not over the run-up starting in the second half of October). Across some of the largest blockchain networks by active users, Ethereum and Solana have seen active address growth of ~30k and ~100k over the past few days, respectively.

In the chart above, we can see that while Bitcoin breaks out heavily in late October, on chain user activity did not materially change. It has not been until the past two days where there has been an inflection in active addresses, primarily driven by Solana.

💫 Artemis Data Insights: Telegram Bot User Growth (Banana Gun, Unibot, Maestro)

Telegram Bots, applications allowing users to trade digital assets directly within their Telegram Chat interface, have taken the crypto trading world by storm over the past few months. During that time, a number of different applications have emerged to compete within that realm.

Today, two Telegram Bots sit among the top three gas guzzling applications on Ethereum: Maestro and Banana Gun. As trading bots proliferated over the past few months, we saw the landscape of user activity across applications change dramatically over the same time.

Unibot was a first mover to the market and captured significant attention from both crypto native and traditional finance media outlets for its innovative design and value capture mechanics, but its usage was quickly overshadowed by competitors that came to market with similar products.

Banana Gun, a competing platform, saw significant growth in activity after launch and has continued to crush Unibot in user activity (that was not helped by Banana Gun launching a token and Unibot getting hacked). Since that time, Maestro, another similiar platform has emerged as a new competitor that has now overtaken both Unibot and Banana Gun in active users.

This tight competition and rapid rotating of user activity from platform to platform points to the low-stickiness and difficulty of retaining users in an environment where token and trading incentives are the primary drivers of user attention and value. With that said, the recent gas consumption statistics of Maestro and Banana Gun indicates that enabling low friction on-chain crypto trading continues to be a core driver of gas usage.

Detailed dashboard for people who love more numbers in smaller font:

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism (source: Token Terminal). Weekly commits and weekly dev activity as of 10/30/23.

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments.

Bitcoin is truly on the up. I find tracking early whales is a good indicator of where the market is heading.

I analysed a whale using Loch (New Analytics tool I found). This whale holds $1b worth of $BTC with a cost basis of just $10m. That means his average cost per bitcoin is just $380!! And he's still not selling

Check out his wallet here - https://app.loch.one/home/12tkqA9xSoowkzoERHMWNKsTey55YEBqkv?redirect=intelligence/costs