This week, crypto companies flood to Ireland ahead of MICA, Uniswap Labs turned on the fee switch, and JP Morgan believes the SEC will approve the BTC ETF by January.

let’s jump right in 👇

🌞 Review of Metaplex Investment Thesis (Modular Capital)

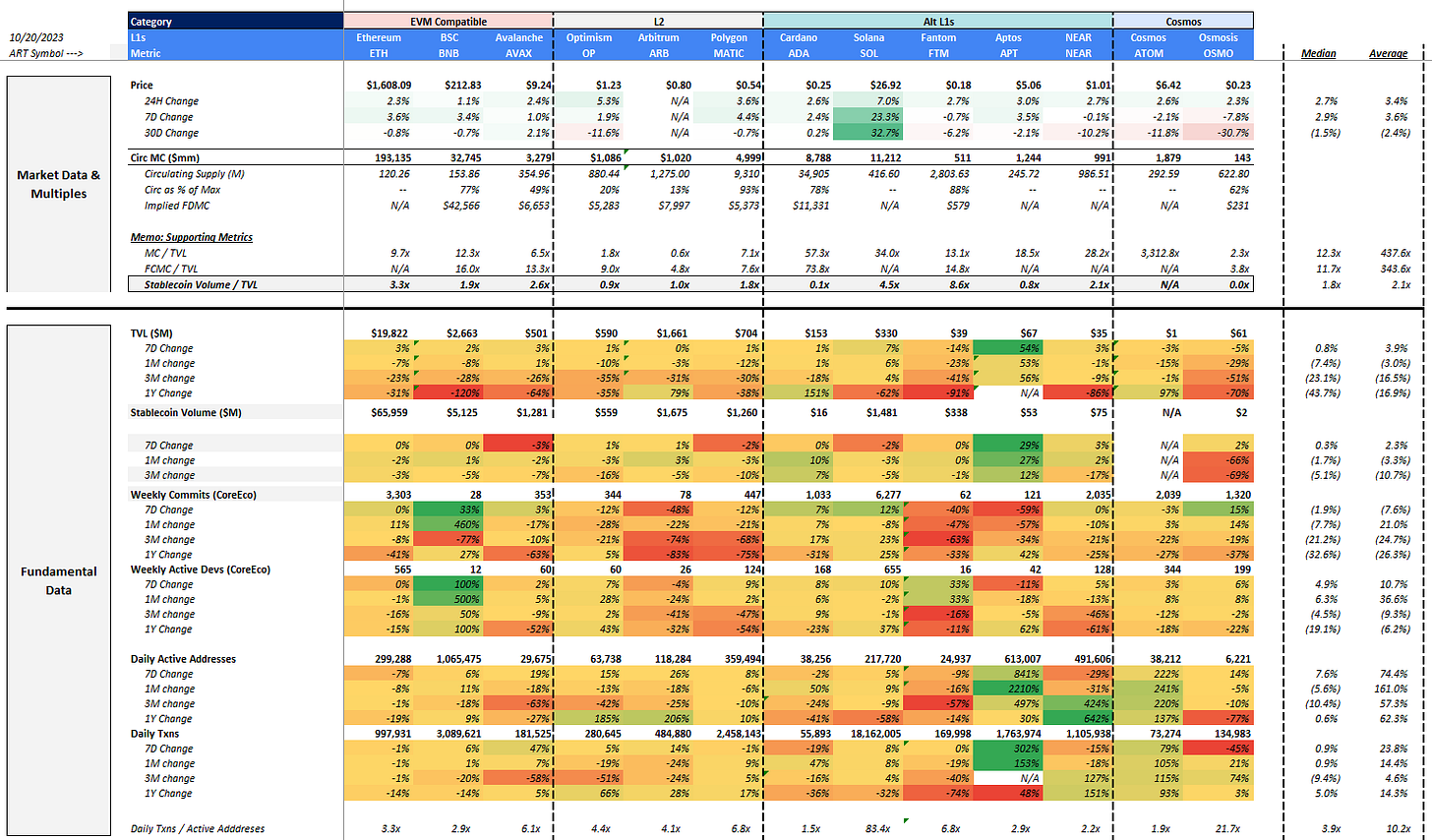

💫 Artemis Data Insights:

friend.tech dominates active addresses and gas usage on Base

Q3 2023 gas usage across top Bridges declines ~32% QoQ

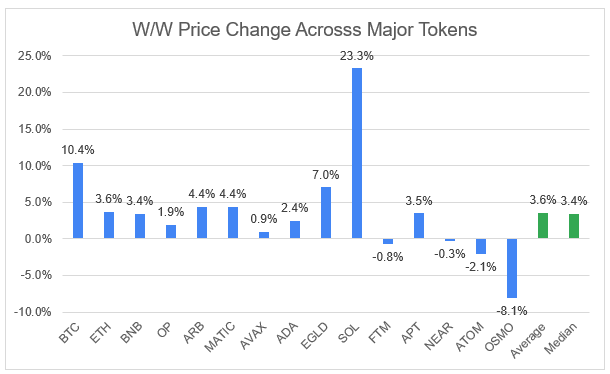

L1 / L2 market prices saw average and median WoW increases of 3.6% and 3.4%, respectively, led by news that a BTC ETF could be approved by the SEC as soon as January 2024. BTC saw a ~10% WoW price increase while the rest of the crypto ecosystem gained alongside it with ETH-related tokens (ETH, ARB, OP, MATIC) up ~4% WoW. SOL led the pack with a whopping ~23% WoW gain, partly driven by a massive week of institutional inflows to digital asset investment products holding the altcoin. SOL’s ~$24mm weekly inflow was the largest week of inflows since March 2022 (CoinShares).

Meanwhile, equity markets chopped downwards (S&P 500 and NASDAQ index down ~2.7% and ~3.5% over past 5 days, respectively).

🌞 Review of Metaplex Investment Thesis (Modular Capital)

This week, Modular Capital, a fundamental, thesis driven crypto investment firm published an investment thesis on Metaplex, an NFT infrastructure protocol in the Solana ecosystem. Today, we dive into their paper to understand the core drivers behind their investment thesis.

Metaplex Overview:

Metaplex is a dominant NFT infrastructure protocol in the Solana ecosystem facilitating ~99.9% of NFT mints

The protocol currently supports several applications that allow creators to create NFTs and launch self-hosted mint pages through a set of APIs and low-code tools

Metaplex offers both infrastructure and applications tools, including but not limited to:

Token Metadata - Solana program responsible for attaching additional metadata to fungible / non-fungible tokens (e.g. name, symbol, royalty fees, traits, etc.)

Candy Machine - the leading distribution / minting program for NFT collection launches on Solana

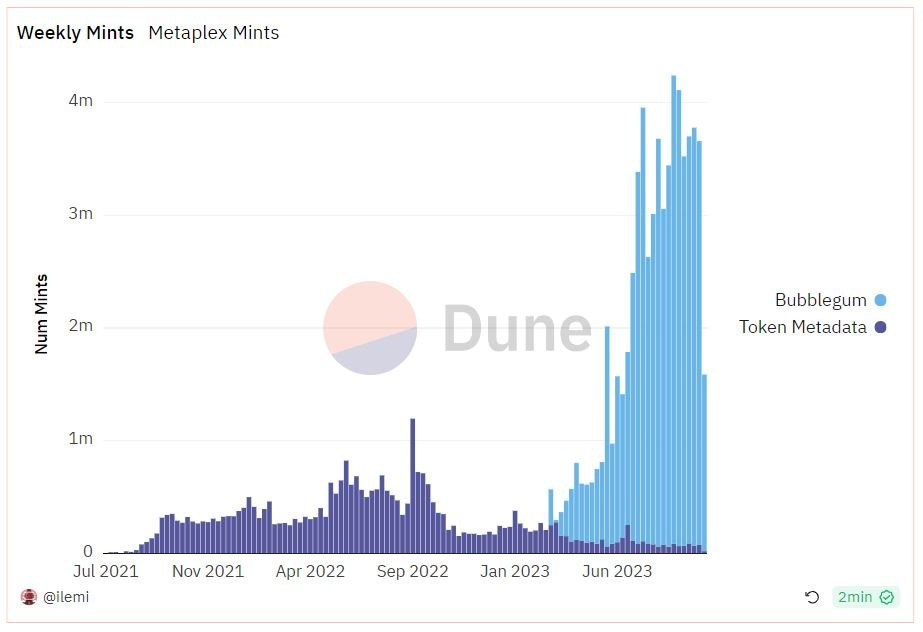

Bubblegum - Solana program allowing for the creation of and interaction with “compressed NFTs,” a new breakthrough in NFT technology enabling businesses and individuals to mint NFTs on a massive scale without incurring the prohibitive associated costs compared to conventional NFTs

To date, Metaplex has facilitated ~144k+ collections, ~61mm+ NFT mints, 14mm+ collectors and ~$1.1bn in creator revenue

Metaplex is currently trading at a fully diluted valuation of ~$33mm

Metaplex Business Model / Monetization

Until May 2023, Metaplex operated all of its products without cost to its users. The company previously raised $47mm of venture financing from Multicoin Capital, Jump Crypto and many other funds which has funded the development of the broad suite of products currently offered by Metaplex.

Starting in May 2023, Metaplex announced plans to introduce a small fee for usage of its “Token Metadata” program. Each new NFT minted using the “Token Metadata” program would generate ~0.01 SOL for Metaplex.

In 2022, Metaplex facilitated 22mm NFT mints, which would translate into ~$5.9mm in revenue if Metaplex monetized at 0.01 SOL (~$0.27) per mint at today’s price, and ~$13.9mm in revenue if they had monetized throughout 2022 at each day’s SOL price.

Importantly, the minting of compressed NFTs via Bubblegum will not generate fees for the time being. While Bubblegum has seen massive growth in weekly mints since its launch earlier in 2023, the program will not generate any excess cost to its users for now.

Valuation Scenarios & Core Assumptions

Modular Capital’s Base Scenario assumes that Metaplex can grow to a market cap of ~$500mm from its current FDV of ~$30mm. This takes into account the following operating assumptions:

Metaplex charges a similar ~83% mark-up on its compressed NFT product as they do for their traditional mints. This would only increase the price of a compressed NFT from ~$0.002 to ~$0.004 in USD terms, which would be unlikely to affect volumes of NFTs being minted

Metaplex achieves ~32.5mm Token Program mints (~50% above 2022 levels) and 2.5bn compressed NFT mints (vs. 2023 run-rate compressed NFT mints of ~180mm) and SOL price increases to $40

This would result in ~$20mm of mint revenue (calculated as average of ~$0.02 per NFT across 2.5bn NFT mints).

In addition to revenue from the core minting product, Metaplex is able to contribute value-added services around the management and sale of NFTs (similar to how Shopify provides a full suite of tools to allow an online merchant to create / maintain a store)

Assuming that Metaplex is able to build a full stack service for the issuance and management of NFTs, the company could add another ~$5mm of software revenue (at ~$10-20/month, a $5mm revenue figure would require 20-40k subscribers)

The ~$25mm of revenue that Metaplex generates ($20mm of mint revenue, $5mm of software revenue) would trade at a 20x valuation multiple

Risks and Mitigants

Modular also provides a list of key risks to their thesis playing out.

NFT use cases are still early and emergent: Ultimately, the success of Metaplex is highly dependent on the proliferation and continued usage of NFT programs that have largely been related to speculative JPEGs to date. While we have seen experimentation among other use cases (messaging, payments, creator content), it remains to be seen if these use cases are durable

Solana Ecosystem Dependency: Today, the vast majority of on-chain activity sits within Ethereum and EVM compatible ecosystems, and it remains to be see whether Solana will be able to sustain usage and adoption over time vs. its EVM peers

What do you think about Metaplex? Tell us in the comments below, and be sure to check out the full piece here!

💫 Artemis Data Insights: friend.tech dominates active addresses and gas usage on Base

Since the Base blockchain launched in July 2023, one application has consistently seen the highest levels of gas usage on the network: friend.tech

The application has consistently beat out other top gas guzzling applications including bridges such as Layer Zero and Stargate, and DEXs such as 0x and Baseswap.

friend.tech has seen a huge influx of new users in the past week (yellow bar is new users, purple is existing users) after primarily seeing usage from existing users throughout September 2023. As the platform continues to cement itself as a premier de-soc platform, it will be interesting to see how retention of existing users vs. growth in new users shifts over time.

💫 Artemis Data Insights: Q3 2023 gas usage across top Bridges declines ~32% QoQ

After Stargate and Layer Zero took the world by storm in Q2 2023 with massive inflections in usage and gas fees, blockspace demand for bridges declined significantly over the past quarter. Total gas usage for the top 5 bridge applications fell from ~$11.4mm in Q2 2023 to ~$7.7mm in Q3 2023.

Active addresses tell a similar story - after peaking in May 2023, active addresses came down across across most EVM blockchains (Arbitrum, Avalanche, BNB Chain, Optimism, Polygon) except for Base, which launched in Q3 2023.

However, there has actually been an increase in active addresses on Ethereum mainnet for that group of bridge applications.

The increase in active addresses appears primarily driven by Socket, and its SocketGateway and Socket: GasMovr contracts.

While bridge gas usage has declined, we expect that activity could rebound as more applications are deployed on layer 2 solutions that will require users to move tokens across different blockchains.

Detailed dashboard for people who love more numbers in smaller font:

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism (source: Token Terminal). Weekly commits and weekly dev activity as of 9/29/23.

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments.