This week, OpenAI raised a record $6.6 billion in venture financing amid executive departures and a shift towards a for-profit structure (Axios), Hamster Kombat's HMSTR token debuted on TON with a $1.2 billion trading volume in 24 hours (Decrypt), and Su Zhu and Kyle Davies launch Three Arrowz Capitel memecoin, down 50% since launch (Protos).

🌞 EIGEN token begins trading as transfer restrictions are lifted

💫 Aerodrome tops $1 billion in TVL, dominating DeFi on Base

The market reacted mostly negatively to mostly negative macro news that spooked investors. Specifically, the conflict in the Middle East has continued to escalate and bring fear to the markets, and the world awaits the next move. This meant top assets were down an average 7.2%, with OP down 15.4%. In spite of this broader market downturn, Sui and Aptos persevered, each posting about 7% in gains. Sui network TVL breached $1bn for the first time as memecoin trading attracts liquidity, while Franklin Templeton announced they are bringing their FOBXX money market fund to Aptos.

Franklin Templeton’s news was not the biggest to come out of the institutional sphere this week. Visa, one of the world’s largest payment card networks, announced the creation of the Visa Tokenized Asset Platform (VTAP), which will help bridge existing fiat currencies with blockchains. They have partnered with BBVA, one of the world’s largest banks, who will use VTAP to create tokens on Ethereum with expected live pilots in 2025 (Visa). Also this week, Swift, providers of the main messaging network through which international payments are initiated, announced they would be doing live trials of digital asset transactions in 2025 (Swift).

In more positive macro news, the US Jobs report surprised analysts as the number of job openings increased for the first time in two months, while hiring was soft and consistent with a slowing labor market that keeps the Federal Reserve on track to cut interest rates again in November (Reuters). On the back of this news, the Dow Jones Industrial Average closed Friday at all time highs, indicating investor confidence in the strength of the US economy (CNBC). In China, stocks continue their rally, as the Shanghai Composite Index posted 20% gains through Sept 30th before closing for the Chinese holidays. Offshore Chinese ETF’s like Blackrock’s MCHI continued to post gains last week, indicating continued investor optimism in the Chinese markets.

🌞EIGEN token begins trading as transfer restrictions are lifted

This week the Eigen Foundation upgraded the EIGEN token to enable transferability. The upgrade was performed at exactly 00:00 ET on October 1st, which infuriated some Polymarket bettors. Jordan Leech at The Block writes:

“Polymarket bettors taking the “Yes” side on the EIGEN airdrop saw their fortunes quickly reverse, after the Eigenlayer Foundation posted on X that the token unlock would take place on Sept. 30th at 9 p.m. Pacific Time—exactly one minute after the prediction’s predetermined settlement time of 8:59 p.m. Pacific Time (11:59 p.m. Eastern Time).”

The token is currently trading at a market cap of $680m, making it the 113th largest cryptocurrency, while trading at a $6.1bn fully diluted valuation which would rank it at as the 32nd largest by that metric. This massive valuation comes as little surprise considering the excitement around the protocol, and the restaking sector more broadly.

Eigenlayer saw activity explode in the early months of the year. Eigenbeat data shows that netflows were large and positive between January and May 2024, as hundreds of thousands of ETH flowed into the protocol. Despite an early summer exodus, TVL has remained largely stagnant as new entrants took the place of those that left. It seems those that have deposited ETH in Eigenlayer are now in it for the long run, and are not withdrawing or depositing as much as they used to.

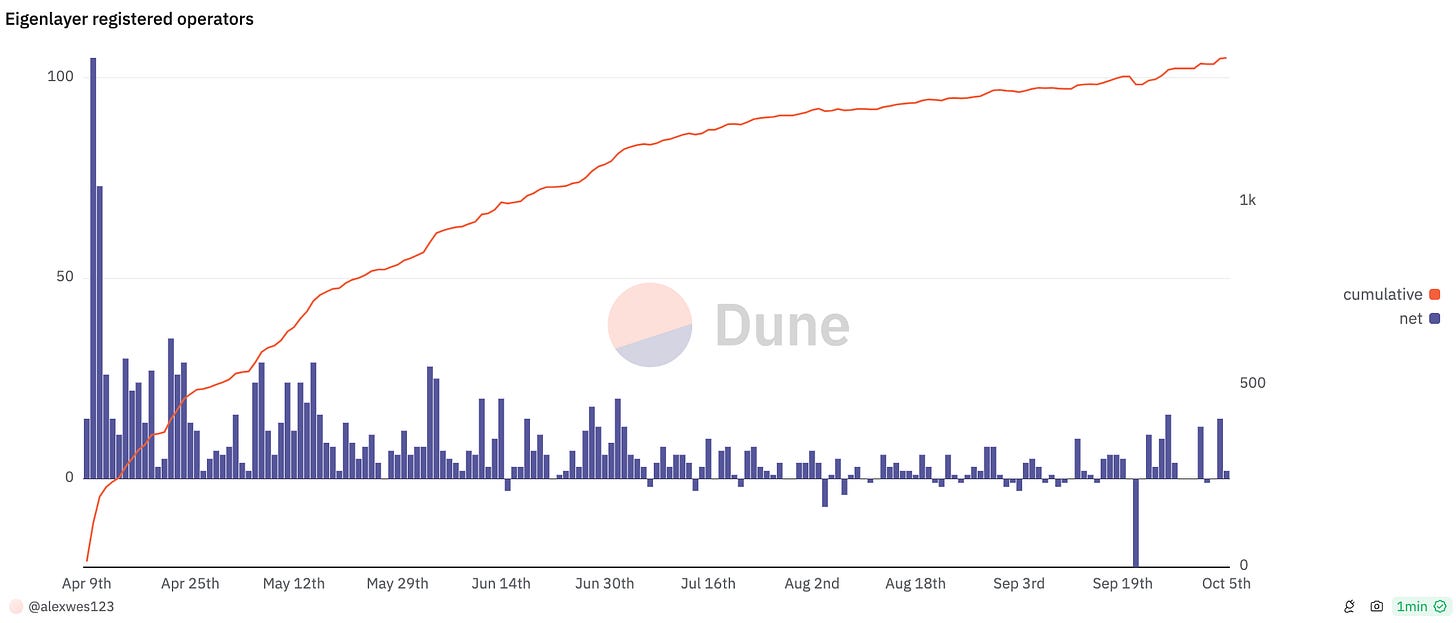

However, this stagnation does not mean that the protocol has not seen other growth. Looking at the amount of operators that have been joining the network we can see the that new operators have been onboarded steadily throughout the year, albeit slowly.

On the Artemis Terminal we can explore further by looking at the Liquid Restaking dashboard. Two interesting points stand out:

Etherfi, one of the first liquid restaking protocols, had its share of the market shrink to as little as 30% in March 2024, before roaring back to where it stands today at 54% of the LRT market.

Once a serious contender for Etherfi’s crown with 33% market share, Renzo has fallen off to command a measly 8% of the market, behind Eigenpie (11.76%) and Puffer Finance (14.3%).

Resetaking is one of the most hotly debated ideas in the blockchain space these days. Restaking optimists hope that it will enable novel protocol architectures by reusing Ethereum’s existing economic security. Projects like Lagrange (ZK coprocessing), Hyperlane (interoperability), and Espresso (decentralized sequencing) are already building novel products, and we can’t wait to see how they’ll do!

💫 Aerodrome tops $1 billion in TVL, dominating DeFi on Base

Aerodrome is a decentralized exchange with a unique tokenomic design. Traditional AMMs like Uniswap distribute transaction fees to liquidity providers, while the native protocol token, UNI, does not hold much utility beyond governance and a potential future fee switch. On the other hand, Aerodrome has a circular tokenomic design whereby fees generated on each pool accrue to AERO stakers. Instead of fees, LPs are incentivized to provide liquidity through epochal AERO emissions. Additionally, Aerodrome allows 3rd party protocols to ‘bribe’ liquidity providers with an additional layer of token incentives natively built into the Aerodrome protocol.

Aerodrome launched natively on Base, Coinbase’s Ethereum rollup in August 2023. In a little over a year, it has become the booming rollup’s premier DEX, reaching $1bn in total value locked last week, accounting for about half of all TVL on Base.

Notably, Uniswap launched on Base several months before Aerodrome. In spite of this, Aerodrome has usurped it as the leading DEX. Data by Artemis and Defillama shows the evolution of the fee landscape between Uniswap and Aerodrome (on Base).

Although Uniswap had a significant headstart, today it makes up only 33% of fees DEX fees generated when compared to Aerodrome.

Significantly, Aerodrome has generated >$1m in weekly fees since mid-July, and these have increased week over week as Aerdrome Slipstream has taken market share. Is this new DEX model a better way of incentivizing all parties involved? The old models failed to appropriately address key stakeholders like token holders. Head to head in a fledgling rollup like Base, the new model appears to have won out. Uniswap is still the dominant DEX across all chains - it is the most time tested and one of the best respected brands in DeFi. The market is appears to be shifting: will Uniswap be able to maintain its headstart and liquidity moat when competing protocols offer more attractive tokenomics?

Liquid Token + Crypto VC Roles

See below for job postings from friends of Artemis! Feel free to reach out directly to us if you’re interested in applying / learning more about the roles!

Detailed dashboard for people who love more numbers in smaller font:

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism.

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments.

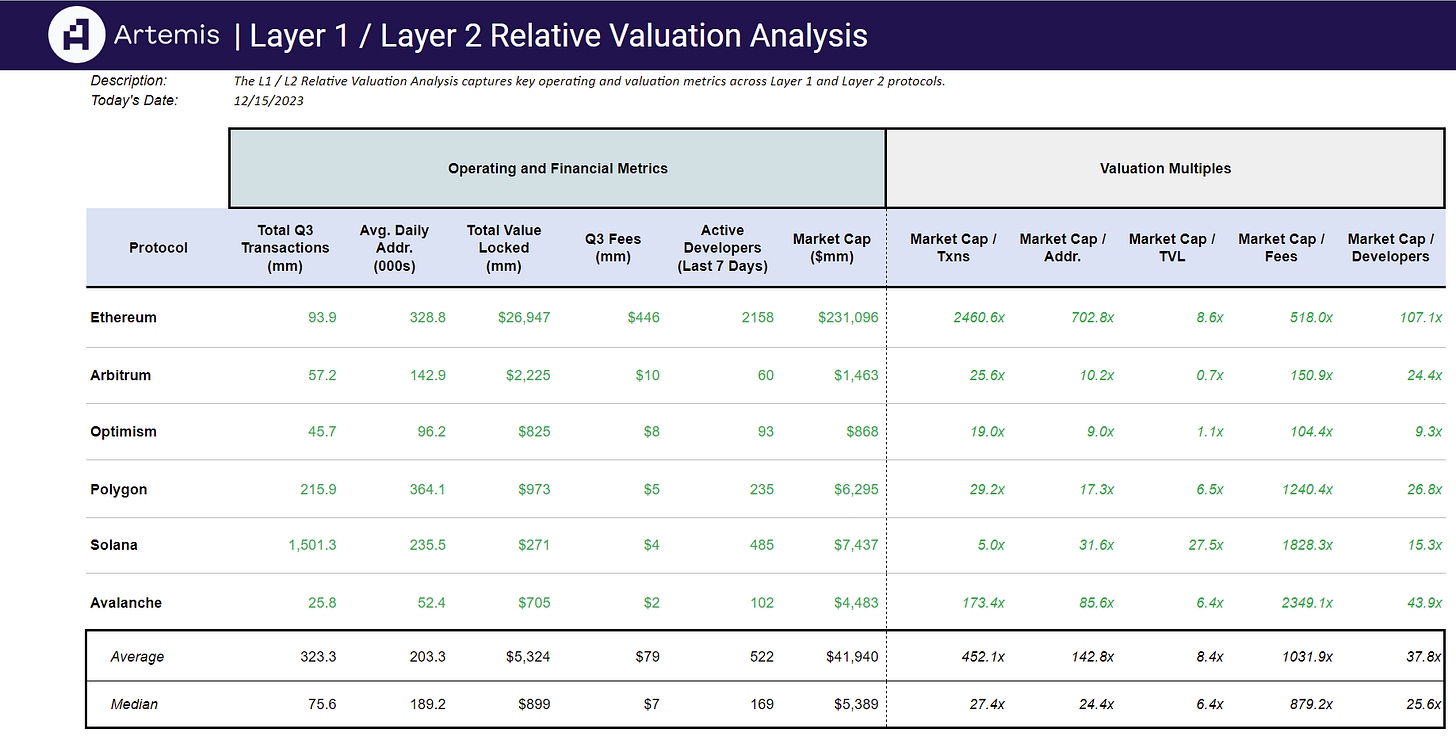

Artemis Sheets

Check out other analyses such as the Artemis Relative Valuation L1 / L2 Analysis in Google Sheets here! Track valuation multiples across key operating metrics for top blockchain including Ethereum, Arbitrum, Optimism and Solana.

Powered by Artemis Sheets 🌞