This is a special two week edition since the team was away in Singapore last week for Token2049 and Solana Breakpoint. More below on the team’s experience in Singapore!

In the past two weeks, the SEC settled with NFT-based restaurant Flyfish Club for $750k alleging an unregistered securities offering (Yahoo), Coinbase to bring native cbBTC to Solana (Cointelegraph), Jump Crypto’s Frankendancer Solana client goes live on Mainnet + Firedancer live on testnet (The Block) and Roman Storm’s (Tornado Cash) motion to dismiss his criminal case is denied and will proceed to a trial (DLNews).

💫 Sui leads the pack: an analysis of key drivers

🌞 Artemis team goes to Singapore

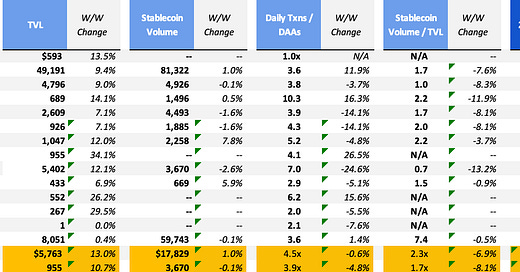

Crypto assets have seen massive growth over the past two weeks in the wake of Fed rate cuts and major crypto conferences in Singapore brewed excitement in the industry. Among all the gains, one asset stands out above the rest: SUI is up over 60% over the past two week! This has stirred the community with many conjuring that Sui may be the next Solana in terms of growth and general adoption. Surprisingly, Aptos, another Move-language based chain was the 2nd largest gainer over the past two weeks. Is this part of a larger shift to Move chains? Benchmark assets BTC and ETH both underperformed the cohort average as alt coins led the pack.

There have been several important macro developments over the past two weeks that may have contributed to the volatility. First, the US Fed cut interest rates by 50bps in its first interest rate cut since the start of Covid in early 2020, after holding interest rates flat at 5.25-5.50 for just over a year. The Fed’s latest dot plot also indicates expectations that interest rates will be cut by an additional percentage point by EOY 2025, and two percentage points by EOY 2026 (Bankrate). Second, China’s stock market posted its biggest weekly gain since 2008 following announcement of a massive $114bn government stimulus, and its first rate cut in a year (Financial Times). This comes as part of a larger plan to meet yearly growth goals and ameliorate a deteriorating economy by issuing $284bn of sovereign debt (Reuters).

Guggenheim Treasury Securities, a subsidiary of finance giant Guggenheim Capital, issued the first Ethereum-based digital commercial paper (DCP), having received the highest credit rating from Moody’s of P-1. This comes as the tokenized government treasury market recently surpassed $2bn in market cap. GTS aims to address key DeFi challenges like poor credit quality, high fees, and compliance issues, offering a more transparent and compliant digital asset for qualified investors.

💫 Sui leads the pack: an analysis of key drivers

Over the past two weeks, Move based chains Aptos and Sui have outperformed similar-caliber peers like Ethereum, Solana and Near (see chart above). An initial driver to Sui’s upswing since August has been the introduction of Grayscale’s Sui Trust, which today has about $2.5m in AUM (Grayscale). This has added some institutional legitimacy to the network, attracting more sophisticated investors who want exposure to the Move ecosystem.

Among Sui’s key differentiators is it the fact that it uses the Move programming language for smart contracts, providing safer smart contracts and parallel processing. Below is a comparison of the major virtual machines (VMs) that exist in today’s blockchains (GCR). Note that, even though both Sui and Aptos use Move, they have distinct approaches to how they implement it’s asset-oriented design in blockchain architecture. For a deep dive into Move and the difference between Sui and Aptos, see Global Coin Research’s Deep Dive into Move-based Blockchains and for Sui alone, see Artemis’ own deep-dive.

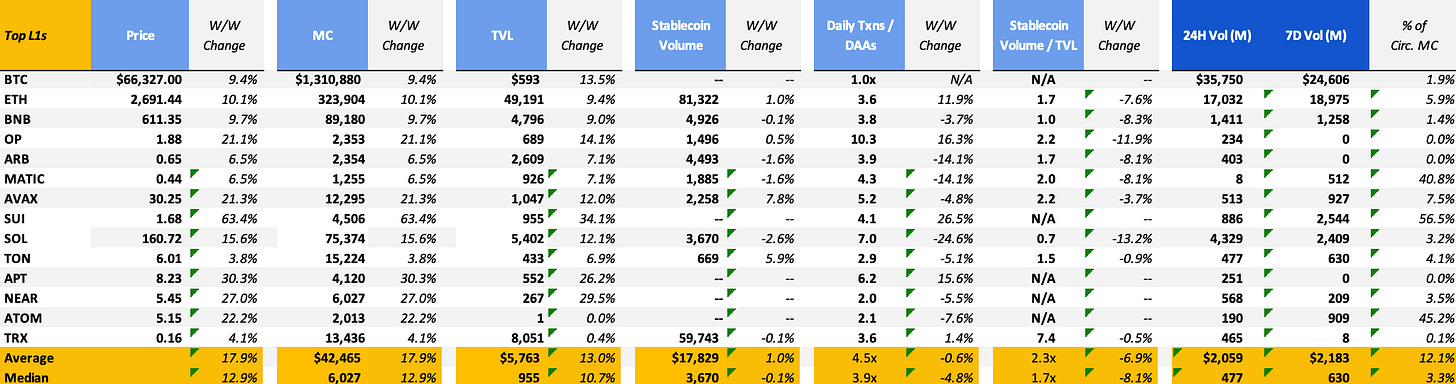

As the price of SUI has steadily risen over the past two months, fundamental metrics like daily active addresses have not only risen, they have also led price. What is driving this rise in activity? Lets find out using Artemis’ Sui Activity Monitor!

By looking at Artemis’ Sui Activity Monitor, we can see that the bar chart indicates the primary application category driving active addresses is the Social category. Further, we can look at the pie chart on the right-hand side to figure out that the majority of these addresses (60% over the past month!) have come from the RECRD application.

RECRD appears to be a new video sharing app built on Sui that gives content creators a new way to monetize their videos by allowing them to be owned as tradable digital assets (NFA, I am learning about this as I write about it). It seem that most active addresses are returning addresses, and that the majority of new user onboards came in the first half of September. It is possible they have stopped allowing new signups as I tried to create an account but was blocked at the signup stage.

Another strange metric that stands out upon further analysis is that daily transaction counts for RECRD only slightly exceed daily active addresses, indicating each address sends, on average, only a slightly more than 1 transaction! This behavior may reflect the unique architecture of the application where one address does not necessarily mean one user. Considering the majority of transactions for the application are `update_videos_watched` and `update_adverts_watched`, we would expect a much higher ratio of transactions per user. That said, this sustained rise is impressive since the app has only launched in India. We will continue to monitor this closely as the app looks to launch globally in the future

While fundamentals seem to have led price in this particular case with Sui, Aptos has not seen the same consistent uptick in active addresses that Sui has, and its price action may be a reflection of attention gravitating back to Move based layer 1s. With major competition brewing in the layer 1 space, as Berachain, MegaETH and Monad all look to launch mainnets soon, it will be interesting to see if chains like Sui and Aptos can capitalize on the unique capabilities of Move and their early-mover advantages to stay ahead.

🌞 Artemis team goes to Singapore

Last week, the Artemis team was in Singapore for two of the largest events of the year: Token2049 and Solana Breakpoint. The team hosted an Alpha with Artemis event on Monday, and cohosted an afternoon networking session along with our friends at Kaito.ai on Friday.

One of our key takeaways from the all the events, side events, and 1:1 we had was that stablecoins are clearly here to stay, and are crypto’s killer app. We were able to meet so many incredible founders working in the stablecoin space that continue to inspire us to build the analytics to support this critical vertical of our industry. The stablecoin report we put out with Castle Island, Visa, and Brevan Howard was a major launchpad for discussion everywhere we went.

One of the best parts of the week for us was to be able to connect in person, face-to-face with so many of our customers, users, and peers that we had previously only met online via Telegram or Zoom. The real strength in these big conferences is the fact that people travel from all over the world to meet in a single city for a week to cowork, connect and, most importantly, have fun.

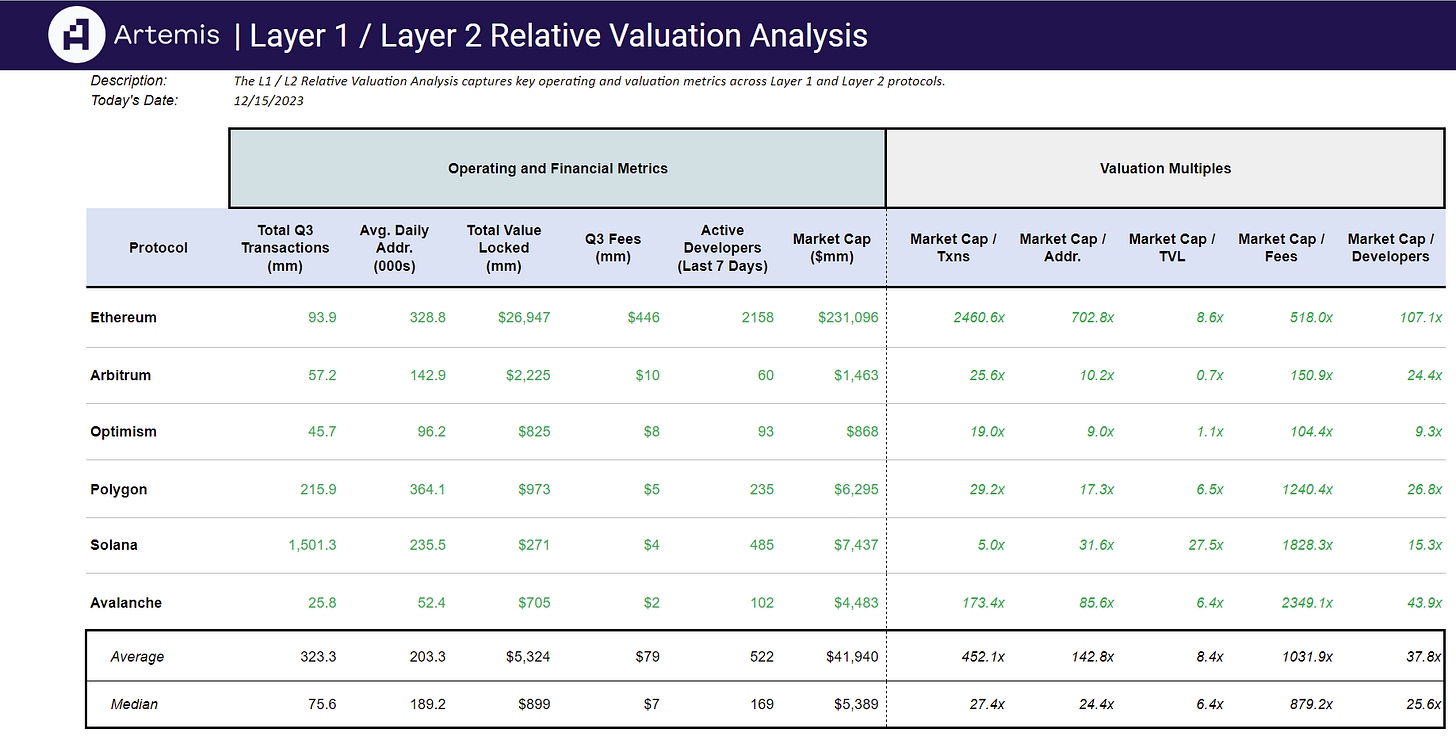

Detailed dashboard for people who love more numbers in smaller font:

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism.

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments.

Artemis Sheets

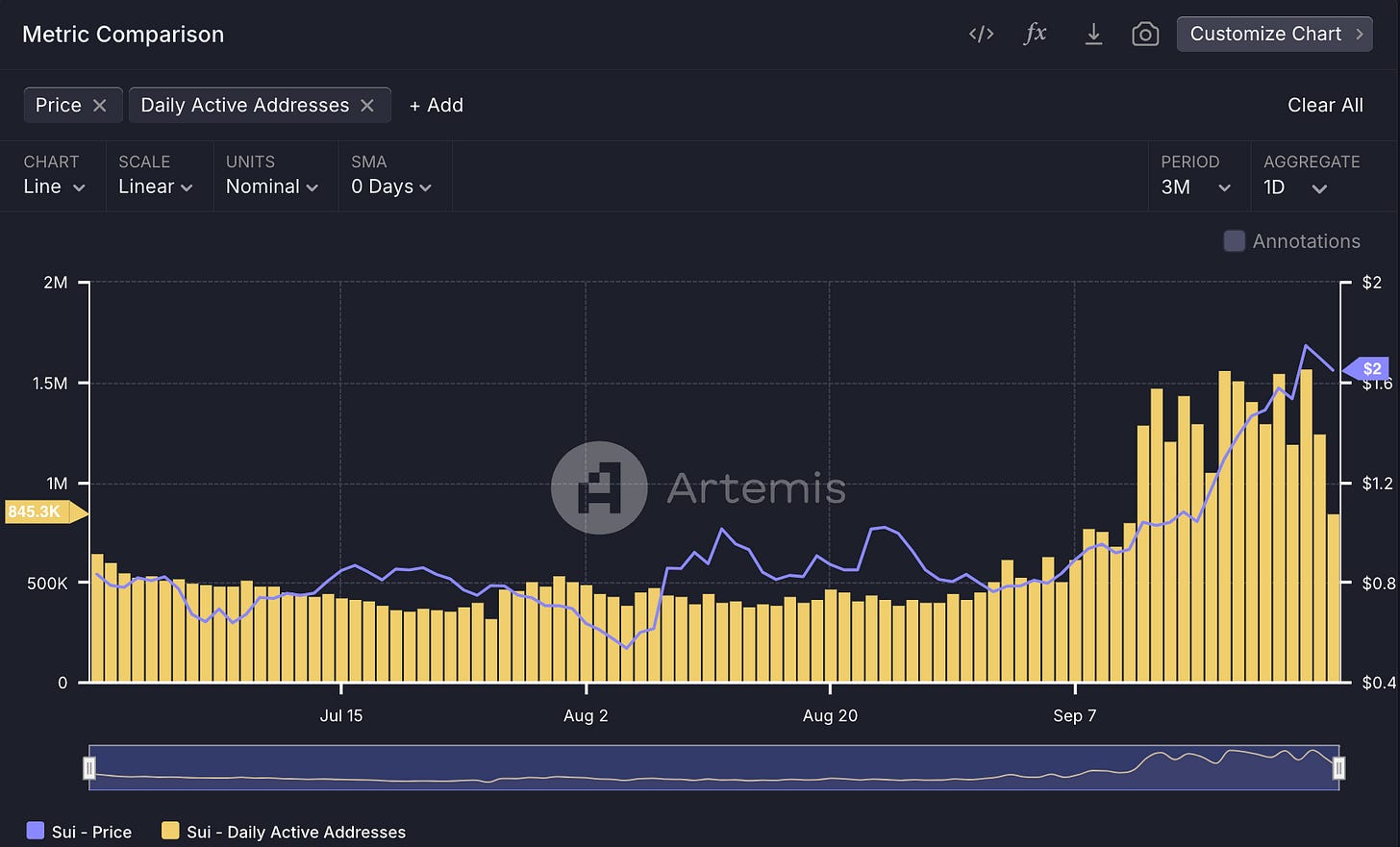

Check out other analyses such as the Artemis Relative Valuation L1 / L2 Analysis in Google Sheets here! Track valuation multiples across key operating metrics for top blockchain including Ethereum, Arbitrum, Optimism and Solana.

Powered by Artemis Sheets 🌞