To all of our readers, Happy New Year! We hope you had a restful holiday season, and we wish you joy and good health in 2025.

Since we last wrote, Pudgy Penguins dropped their $PENGU token, currently at a $3bn market cap; the IRS delayed the implementation of “first in, first out” crypto accounting to the end of 2025 (Yahoo Finance); Tether sees $10bn in net profits in 2024 (Bloomberg); Panoptic Launches Options Trading Protocol on Ethereum (X/panoptic_xyz); and Mo Shaikh, Aptos co-founder, announces his departure (X/moshaikhs).

🌞 2024 Retro: Crypto Market Fundamental Overview

💫 Usual stablecoin protocol launches the USUAL token

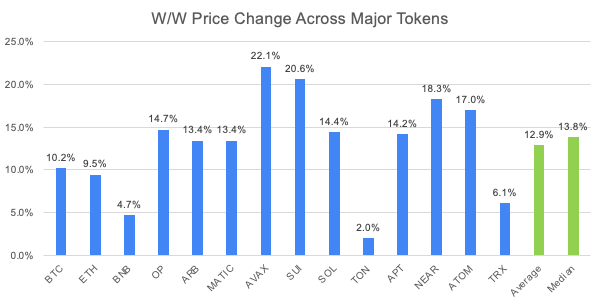

The crypto market experienced a strong rally since the start of the new year, with AVAX (+22.1%) and SUI (+20.6%) leading the gains, well above the market average of 12.9%. Performance was broad-based, as reflected in a median increase of 13.8%, with standout performers like NEAR (+18.3%) and ATOM (+17.0%) joining the rally. BTC (+10.2%) and ETH (+9.5%) posted solid but below-average gains, while TON (+2.0%) notably lagged behind. However, comparing to the last time we wrote before the holidays, markets have largely remained choppy with a skew to the downside over the past 3 weeks, with APT down 27%, OP down 16.6% and ATOM down 16.6% in that time frame. This market downturn came as investors took profits following Bitcoin’s recent all time highs.

The crypto market rebound as we enter 2025 was mirrored in equities markets as the SP 500 retook the 6,000 level, while the Nasdaq approached the 20,000 level once again, threatening all time highs. These moves indicate market optimism as we enter 2025, with Donald Trump expected to be inaugurated as US President on January 20th. This year, all eyes will be on the new administration to live up to the promises and expectations in fostering real and safe digital asset regulation and innovation.

🌞 2024 Retro: Crypto Market Fundamental Overview

As we settle into the new year, we thought it would be useful to take a step back and look at where things stand in crypto fundamentals. Let’s walk through some key metrics and analyze some major developments of 2024.

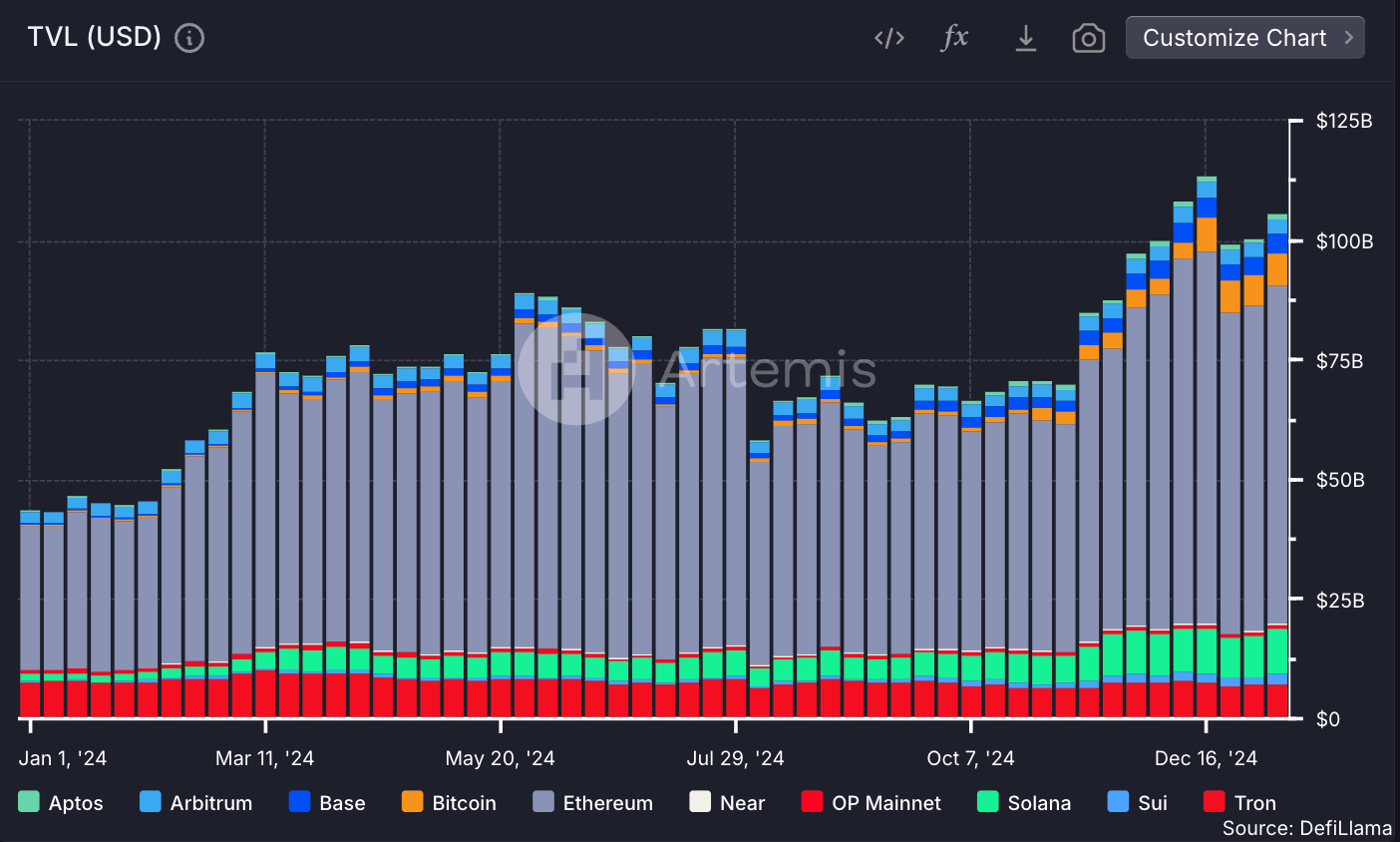

Chain TVL

In terms of total value locked, Ethereum remained king throughout the year, maintaining above 2/3 share of TVL across major chains and L2s. Bitcoin and Solana demonstrated significant growth in TVL throughout the year, while Tron lost significant market share due to stagnant TVL growth. Sui and Base are two noteworthy chains/L2s that started the year with <1bn TVL and ended with >2bn, indicating massive growth of economic activity.

Chain Daily Active Addresses

Looking at daily active addresses across major chains and L2s is one way of telling the story of Solana’s growth, having raced from a 12% share at the start of the year to a 35% share today. Memecoin trading was a large catalyst for this growth, while Solana DeFi proved robust and innovative via protocols like Drift, Raydium and Orca.

Perps Trading Volumes

One of the major stories of the year was the growth of the Hyperliquid perpetuals exchange. The exchange aims to provide a CEX-like experience while remaining an onchain perpetuals exchange. It has grown massively this year, and today commands 66% of perps trading volume, having peaked at >$50bn in weekly trading volume in December. The Hyperliquid L1 is evolving with general purpose smart contracts and applications launching soon. Another noteworthy story has been the growth of Jupiter perps which started the year with 2% market share and ended with 12%!

DEX Trading Volume

Looking at DEX trading volume reveals more of Solana’s memecoin trading growth. DEX fees tell a similar story. Memecoin’s created on the popular pump.fun platform may ‘graduate’ to being traded on the Raydium exchange which has led to the exchange doing nearly $80bn in trading volume on certain weeks, and completely dominating the DEX space in terms of trading volume.

That said, looking at DEX TVL tells a different story of Uniswap’s dominance as it continues to be the liquidity hub for major assets like ETH, BTC, and their derivatives.

Stablecoin Supply

One of crypto’s killer use cases, stablecoins, had a breakout year as supply grew steadily from 125bn to 200bn, Stripe acquired Bridge, and major fintechs poured investment money into the space. Ethena’s USDe was a major story in stablecoins: released in Dec ‘23, it grew to surpass DAI in supply. We expect stablecoins to accelerate their growth and adoption in 2025.

App/Chain Fees

On a 30D annualized fee basis, the dominant protocols at the end of 2024 are mostly Solana related (Raydium, Jito, Solana, Jupiter), or Ethereum related (Ethereum, Uniswap, Lido, Aave, Maker), further indicating the dominance of these two chains. While we don’t have the chart in front of us right now, we imagine a year ago this looked pretty different! We’re excited to see what new successful businesses emerge in 2025.

The blockchain landscape changed dramatically in 2024 as the Solana ecosystem exploded, L2s and alt-L1s continued to grow and compete, Bitcoin hit 100k, and Hyperliquid dominated mindshare. We hope 2025 will bring new challenges and growth to the industry as institutions increase investment in the space, and the regulatory landscape shifts in favor of innovation and safety.

💫 Usual stablecoin protocol launches the USUAL token

The Usual Protocol is a decentralized banking model designed to bridge the gap between traditional finance (TradFi) and decentralized finance (DeFi) by democratizing access to Real-World Assets (RWAs). At its core, the protocol introduces USD0, a fully collateralized stablecoin, and USUAL, a governance token that incentivizes user engagement and aligns economic interests. Unlike traditional stablecoin providers like Tether and Circle, which centralize profits from billions of dollars in revenue without redistributing value to users, Usual aims to offer a more equitable system. It addresses inefficiencies in the stablecoin space, such as limited access to RWAs, the lack of permissionless minting, and the absence of mechanisms to share ecosystem value with participants. By combining transparent collateralization with user rewards, Usual creates a stablecoin ecosystem that empowers users to participate in both yield generation and the protocol’s long-term growth.

Usual aims to redistribute value to ecosystem participants through a novel tokenomic model. At the core of this model is a daily distribution of newly minted USUAL which is distributed to ecosystem participants according to the chart below:

Tokenomics Key Takeaways

USD0 tokens are backed by yield-generating treasuries and other RWAs such as Hashnote’s USYC. In order to access this yield, USD0 holders must stake their tokens in exchange for USD0++, which accrues yield in the form of USUAL emissions (45% of all daily USUAL emissions). USD0 must be locked for a predefined amount of time, and users who wish to withdraw their USD0 before this maturity date must pay a fee.

Insiders such as investors and team members are allocated USUAL* tokens instead of USUAL tokens. The USUAL* token grants holders 10% of the daily USUAL emissions. The purpose is to align insiders with the long term success of the protocol, breaking away from the status-quo of short-sighted tokenomics models that enrich insiders at the expense of the community.

Liquidity providers in approved pools receive 15% of daily emissions, incentivizing deeper liquidity for Usual trading pairs. Additionally, market makers are allocated 2% of emissions.

The protocol has a DAO that is governed by USUAL/USUALx holders. The DAO's purview includes making changes to key protocol risk and emission parameters, as well as managing the DAO's treasury. The treasury accrues value via RWA yield, USD0++ redemption fees, as well as USUAL emissions. Crucially, the DAO also governs the insurance fund, a critical piece of infrastructure in the Usual protocol that may be used to stabilize and mitigate the price of the protocol’s stablecoins in times of market stress.

Usual Protocol Metrics

The protocol’s core product, the USD0 stablecoin, has seen explosive growth over the past several weeks, with supply more than tripling since the start of December. This coincides with the launch of the USUAL token and associated incentives.

The Usual protocol has generated a cumulative $7.5m in yield from underlying RWA products according to Token Terminal data.

The Usual team hinted that there may be a push towards enabling the fee switch in 2025, an action that would direct a portion of yield to USUAL tokenholders or stakers.

Usual stands out in the hyper-competitive stablecoin space. It is one of the few stablecoin protocols that has a native governance token and is built around yield-bearing real world assets. By aligning insiders with long-term oriented tokenomics, and incentivizing user participation via USUAL emissions, the protocol has differentiated itself from its peers. Concerns remain around whether or not USD0 will achieve adoption in DeFi and if the current growth is only a knee-jerk reaction to the protocol’s token launch. However, Usual has established strong partnerships in the stablecoin/RWA space, including a recent partnership with Ethena and Securitize to use Ethena’s BUIDL-backed USDtb as collateral. Showing an over 300% increase in stablecoin supply since December and now considering activating the fee switch, Usual has already begun to show strength in the market and remains a threat incumbents with innovative tokenomics.

Liquid Token + Crypto VC Roles

See below for job postings from friends of Artemis! Feel free to reach out directly to us if you’re interested in applying / learning more about the roles!

Detailed dashboard for people who love more numbers in smaller font:

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism.

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments.

Artemis Sheets

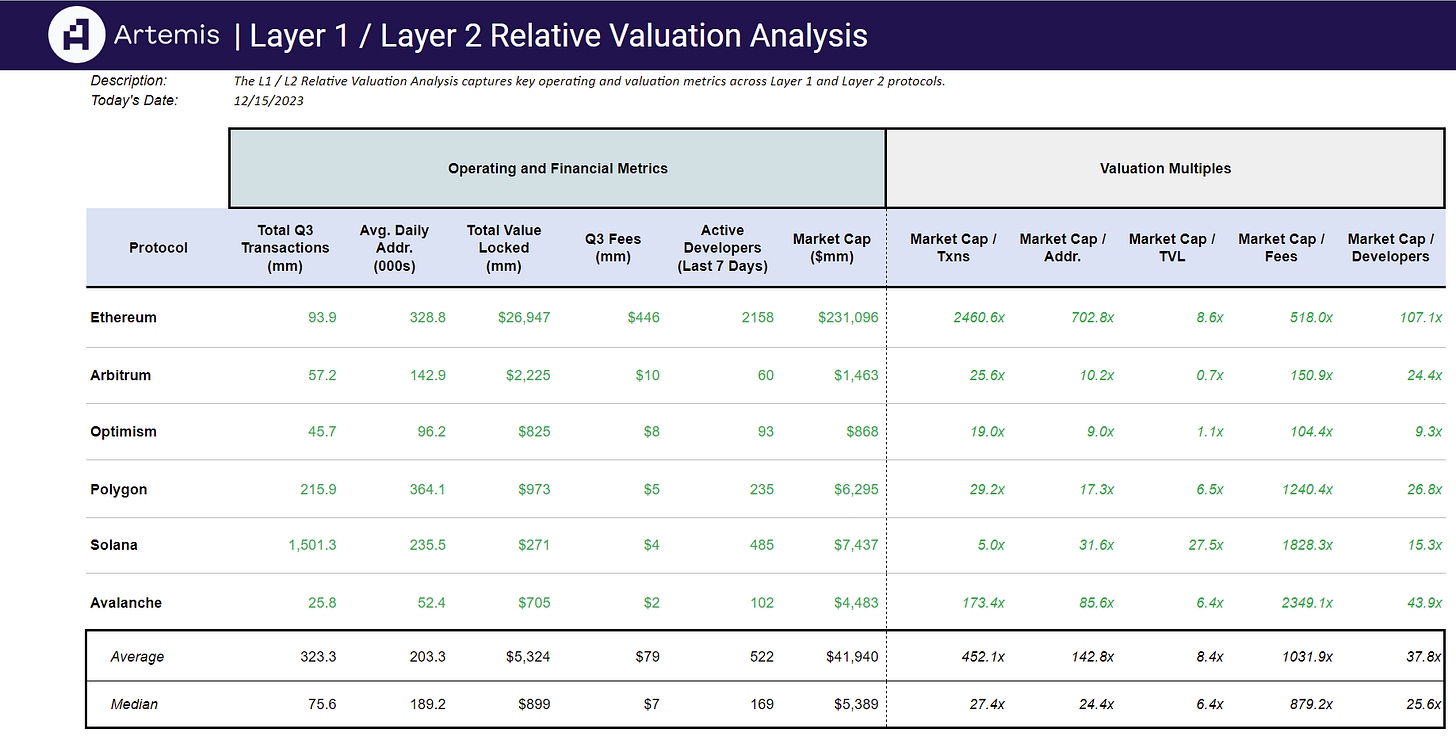

Check out other analyses such as the Artemis Relative Valuation L1 / L2 Analysis in Google Sheets here! Track valuation multiples across key operating metrics for top blockchain including Ethereum, Arbitrum, Optimism and Solana.

Powered by Artemis Sheets 🌞