Artemis Metrics that Matter - Decentralized Perpetual Exchanges

We added the metrics that matter for Decentralized Perpetual Future Exchanges (GMX, dYdX, Gains, Perpetual Protocol)

Hey Artemists,

Jon here 👋. I’m one of the cofounders of Artemis. We’re excited to share that we added ✨ Decentralized Perpetual Future Exchanges ✨ on Artemis!

This is the first category we added onto Artemis.xyz outside of L1/L2 chains!

Decentralized Perp Exchanges offer a decentralized alternative to centralized exchanges like Coinbase, Binance, Kraken, the recently fallen FTX, etc. For more info on how perps work check out this piece by Blockworks.

Metrics that matter for perp DEXs

Trading volume: 🏆 dYdX is #1 in daily trading volume at $981m

Traders: 🏆 GMX is #1 in daily traders at 1.6k)

TVL: 🏆 GMX flipped DYDX and is #1 in TVL at $540m

Gas Paid:🏆 GMX is #1 in daily gas fees paid by users at $2.3k

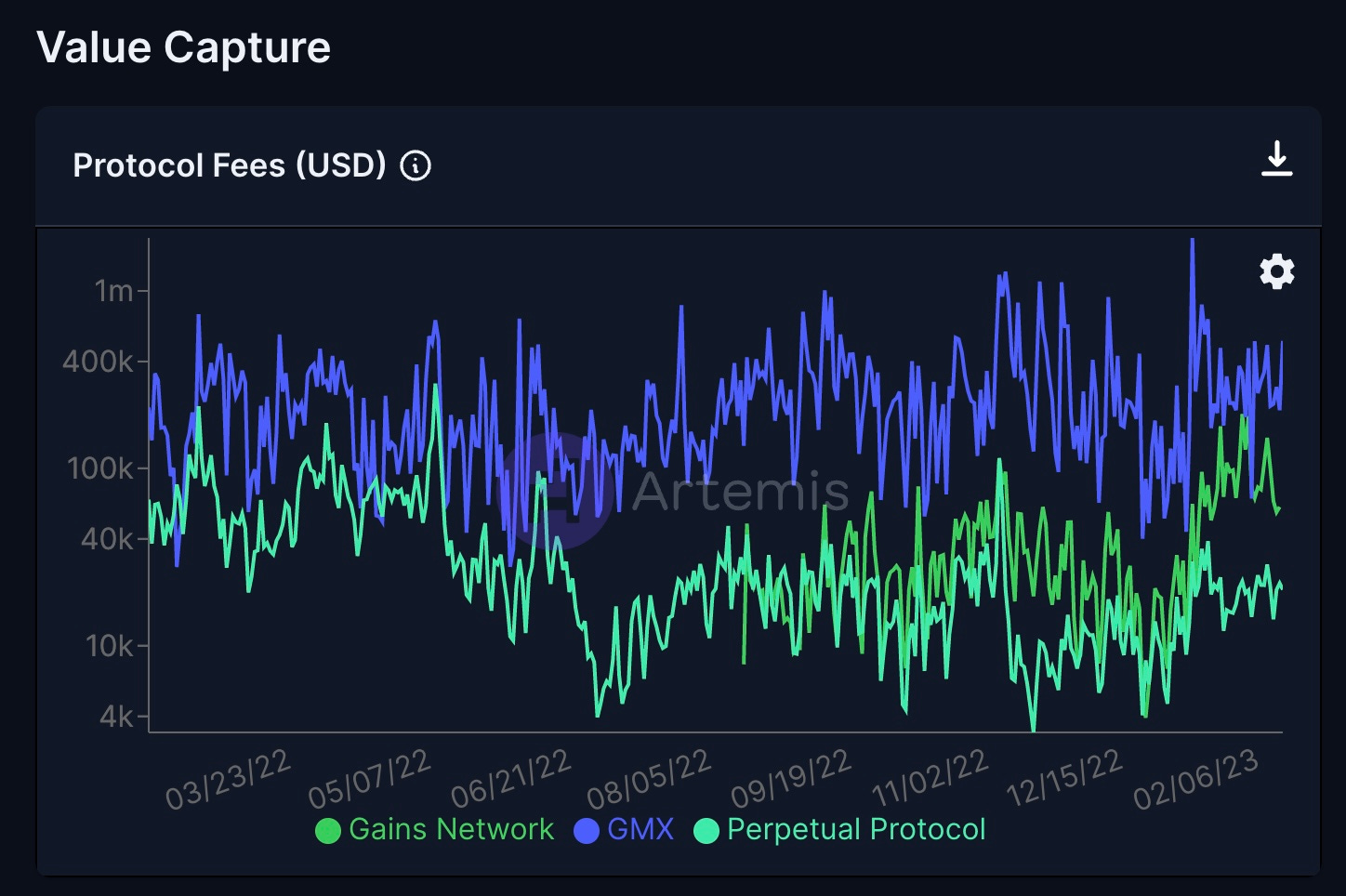

Protocol Fees: 🏆 GMX is #1 in protocol fees at $212k)

Overview

1️⃣ dYdX is a decentralized perp contracts exchange that runs on L2 Starkware but is moving to Cosmos to build its own chain

2️⃣ GMX is a decentralized perpetual exchange on Arbitrum and Avalanche

3️⃣ Gains Network is a decentralized trading platform built on Polygon & Arbitrum

4️⃣ Perpetual Protocol is a perpetuals future DEX which runs on xDai and Optimism

5 takeaways for Perp DEXs

Perp DEXs are up ~100% in 2023 📈 with dYdX leading the way at +153%

dYdX has by far the most trading volume at $981m. That's ~7x that of GMX’s trading volume. GMX is #2 but slightly ahead of Gains Network.

But GMX has the most amount of TVL at $543m. That’s 1.4x that of dYdX, 10x+ larger than Gains Network. It’s worth noting that GMX TVL > dYdX TVL flip happened in late Sept '22 and has continued to persist.

GMX has value accrual with $522k daily fees accruing to the protocol on Feb 7th, 2023 more than other players.

Worth noting that the GMX governance and utility token accrues 30% of the platform fees and GLP the liquidity provider token accrues 70% of the platform fees.

Majority of GMX activity is on Arbitrum (vs Avalanche)

97% of all trading volume is on Arbitrum vs 3% on Avalanche

90% of all traders are on Arbitrum

88% of all transactions are on Arbitrum

85% of all fees spent is on Arbitrum

That’s all folks. Check out the Perp DEX Comparison Dashboard for more 🫡

Cheers,

Jon

P.S Some tweet thread and deep dives from friends of Artemis on Perp DEXs like GMX and Gains Network!