Artemis - Digital Finance Fundamentals (05/11/2025)

Revenue and Earnings is all the matters for DeFi and Fintech. We estimate Bridge at $1.5B/month in TPV w/ 20-30 bps of take rate = $40-$50m revenue run rate.

"What we're trying to optimize over time is earnings per share and free cash flow per share"

- Jason Warnick, CFO at Robinhood Q1’25 Earnings Call

Hey Fundamental Investors,

1. Fundamentals Update

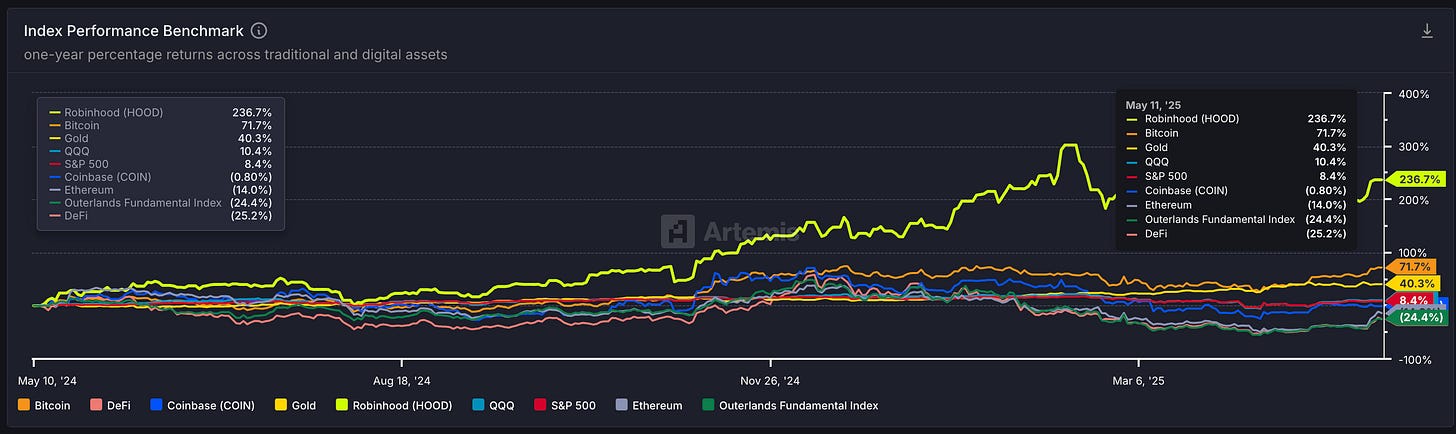

As a capital allocator, we can invest between liquid tokens and equities and this trend will only accelerate with tokenized equities (e.g Superstate launching SOL Strategies equity on Solana)

We should look at the fundamentals between both assets to figure out where to allocate.

The beauty is Fintech and DeFi fundamentals are converging.

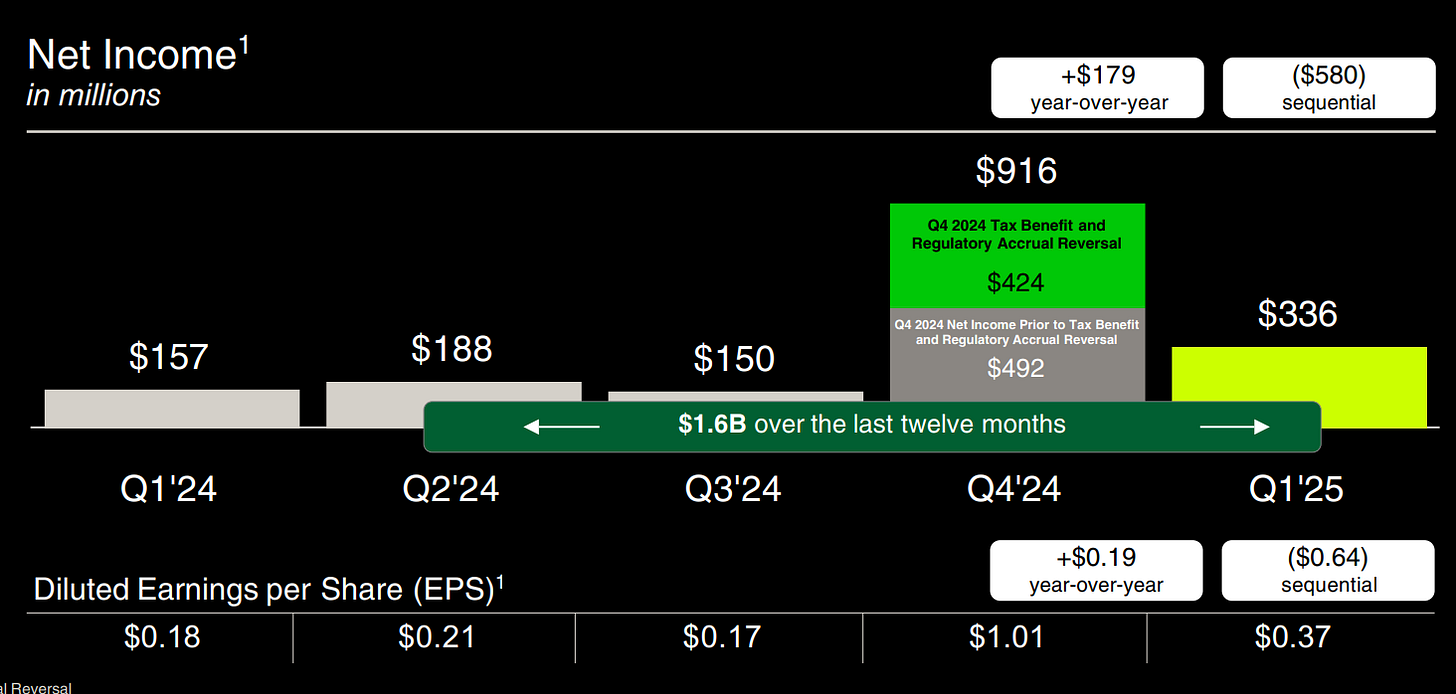

Fintech: Robinhood, a leading fintech with 43% of transaction revenue coming from crypto, is up 237% in price in the last year on the backs of 114% YoY growth in net income generating $1.6b of net income in the last year.

Net income up, price up.

DeFi: Maple, an institutional lending platform which allows verified lenders to loan to market makers, liquid token funds, and trading firms and get 5-9% in yield for overcollateralized loans (read: much safer than uncollateralized loans), is up nearly 153% in price in the last 3 months while annualized revenue run rate is up 210% and TVL is up 226% during that period. Revenue and TVL up, price up.

It’s finally here but markets are starting to value DeFi protocols in terms of revenue and quality of businesses.

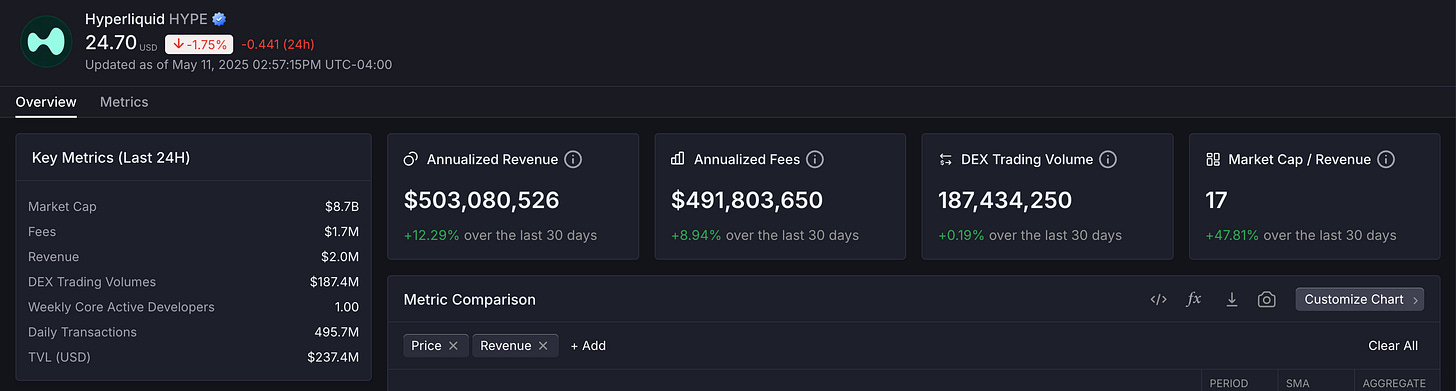

Case in point: Hyperliquid is both a chain but primarily serves as a decentralized exchange that enables anyone to trade perpetual contracts (e.g you can 40x BTC-USDC) or spot trading (e.g buy Hype or Fartcoin or any token that is supported).

The market values Hyperliquid at premium of 16.5x circulating marketcap / annualized revenue which is more than the median of 12x (and higher than Robinhood at 13x revenue).

This is because Hyperliquid:

1. Does a significant amount of revenue at $500m+ annualized run rate revenue (we define as % of trading fees that go to the Hyperliquid Assistance Fund which then buys back $HYPE in the open market which benefits token holder)

Is the market leader in perp DEX volume at ~80% of marketshare up from 15% a year ago and continuing to keep marketshare at almost ~$190B in monthly volume (Robinhood did about ~$145B in equity + crypto + option contracts + margin in March ‘25)

With the upside of an ecosystem built around HypeEVM

DeFi protocol with revenue (value accrual to treasury or through buybacks or burn) traded at 12x MC/Revenue Run Rate whereas for Fintechs it was 6.2x (we use eToro and Circle’s IPO as relevant comps)

Some pieces to note:

Deribit which was acquired by Coinbase for $2.9B at roughly 9.7x EV/Revenue — roughly 50%+ Coinbase’s revenue multiple.

We’ll see a healthy amount more CeFi high growth comps with Circle and eToro going public. We excluded Paypal, Square, SoFi and a few others to keep our comp set closer to Fintechs that are higher growth.

For Circle and eToro at their announced valuation targets for IPO, they trade at 20-32x net income which is in line with Robinhood, Coinbase, Nubank.

I started off my career as a software analyst looking at software KPIs like ARR, ARR Growth Rate, Rule of 40% and Retention, Payback Period. Software businesses in the public markets have become somewhat slow growth (~30% for high growth SaaS) outside of AI businesses — i.e Coreweave is $1.9b revenue growing 736% YoY, .

For AI businesses, it’s also revenue multiples that VCs look at to value these companies:

It’s exciting that for DeFi and Fintechs its increasingly the same fundamental KPI: Revenue, Gross Profit and Net Income and the multiples are converging and not far from one another.

Stay tuned as Artemis adds incentives and OPEX to our platform so we can fill out the earnings and net income portion for DeFi protocols so we have an apple to apple comparison.

Shout out to the Maple team for both disclosing OPEX in their quarterly treasury report— our hope is more protocol teams start doing the same.

2. Market Update

Markets are up significantly in the last month and AI and NFT Apps (which surprised me) have outperformed at ~90%

AI tokens like Worldcoin, Bittensor, Render, Virtuals, Katio, have performed extremely well with Virtuals which enables users to launch AI agents up 265% in the last 30 days.

While down YTD, Memecoins have performed well, up nearly 100% in the last 30 days.

There’s a lot of conversation around CT around ETH’s pullback which I thought Hasu at Lido / Flashbots had a great thread on how sentiment, fundamentals and price shift for Ethereum.

It’s worth zooming out that Ethereum is still where most of the capital is — #2 in stablecoin supply and #1 in TVL and most recently #2 in net inflows. Not surprisingly, Ethereum is still #2 in Marketcap.

Blackrock meeting with the SEC to discuss including in the ETPs are also a great step in the right direction for Ethereum.

3. Stablecoins Update

Stablecoin Supply sits at $236B up 47% YoY. Standard Chartered Bank estimate supply to reach ~$2T so almost 10x from where supply is today.

Chamath is writing on stablecoins and citing Artemis data on how stablecoin transfer volumes are approaching ACH volumes.

Stablecoins have become consensus and a material part of how fintechs move money.

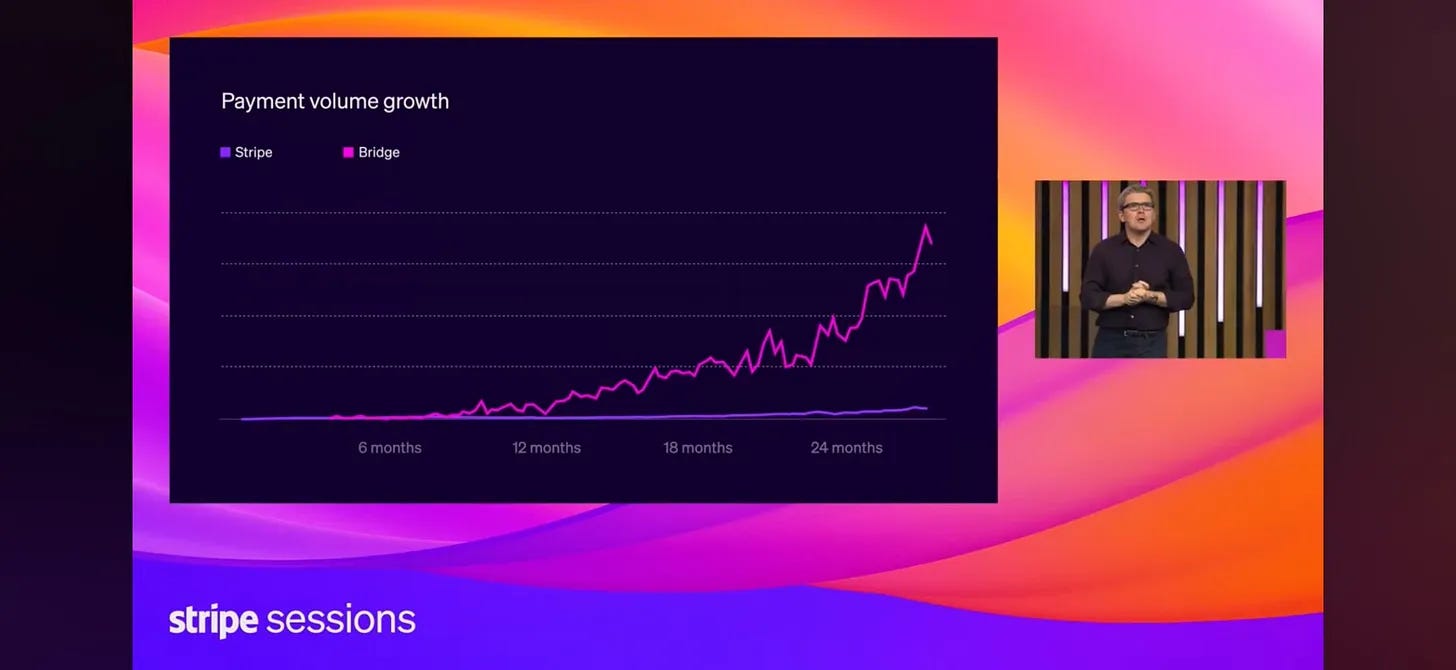

John Collison at Stripe Sessions pointed to Bridge’s growth in its first 24 months versus that of Stripes.

We estimate that Bridge is doing $1.5B of monthly TPV. At 20-30 bps of take rate that’s $36-$54m net revenue run rate which at the $1.1B acquisition value is 20-30x on current revenue run rate which seems quite reasonable.

Stripe launching financial accounts with stablecoins, Meta exploring payout to creators using stablecoins, Ramp launching stablecoin backed cards, even despite the Senate failing to pass the GENIUS act which would provide clear stablecoin regulation

It’s worth remembering the reason why stablecoins matter to these fintechs is how Bridge will add revenue and earnings to Stripe when Stripe inevitably goes public.

Bridget at Founders Fund had a great takeaway which is Stripe sits at $1.4T/year in TPV but with Bridge enabling Stripe to service more cross border payments, a $120T/year market.

What’s interesting is that Stripe can increase its take rate and volume because of stablecoins in facilitating movement of cross border flows for merchants, consumers and also potentially monetizing account balances for merchants that hold USDB which buys and holds short-duration money market funds from Blackrock.

We look forward to observing how the growth of stablecoins turbo charge equity and token businesses and how they ultimately impact revenue and earnings / free cash flow / Net income.

Cheers,

Jon

The authors of this content, as well as affiliates of Artemis Analytics, may have financial interests in the protocols or tokens mentioned. This does not constitute investment advice or a recommendation to buy, sell, or hold any asset. The information provided is for educational purposes only and should not be relied upon for financial, legal, or tax decisions. Readers should assess their own circumstances before making any financial choices. Views expressed may change without notice, and Artemis Analytics is not liable for any losses resulting from the use of this content.