Announcing Stablecoin Activity Breakdown

Find what dApps and smart contracts are driving stablecoin activity per chain

When we launched the Artemis stablecoin dashboard in December ‘23, we were often asked the follow-up question: What apps are driving stablecoin activity?

Solana stablecoin transfer volumes were growing quickly and taking a larger and larger percentage of market share, but customers kept asking us which dapps were driving volume?

Introducing Stablecoin Activity Breakdown

Today, we’re excited to announce our Stablecoin Activity Breakdown to allow analysts to answer these questions and drill into what stablecoin activity looks like by apps, categories, or smart contracts

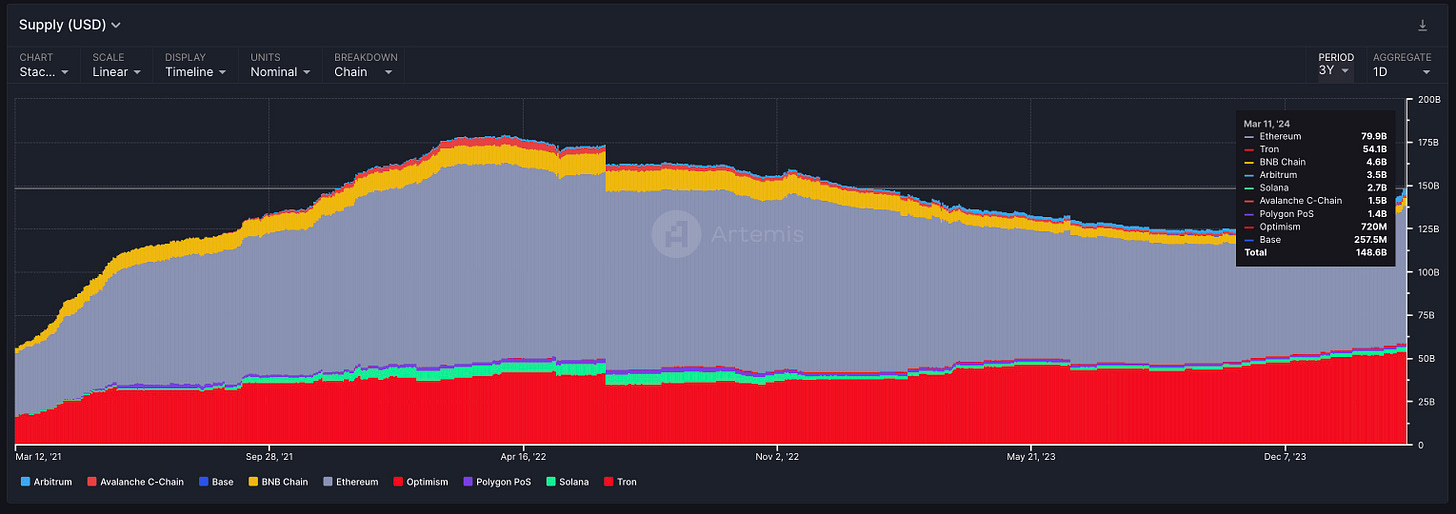

You can now see what apps, categories or smart contracts are driving Transfer Volume, Supply (USD), # of Transfers, and Active Addresses across 9 different chains: Solana, Tron, Ethereum, Arbitrum, Avalanche C-Chain, Base, Binance, Optimism, and Polygon. More chains to come 👀

Check out our stablecoin activity breakdown here by clicking on a given chain

Takeaways

Here are 5 key takeaways from our Stablecoin Activity Breakdown

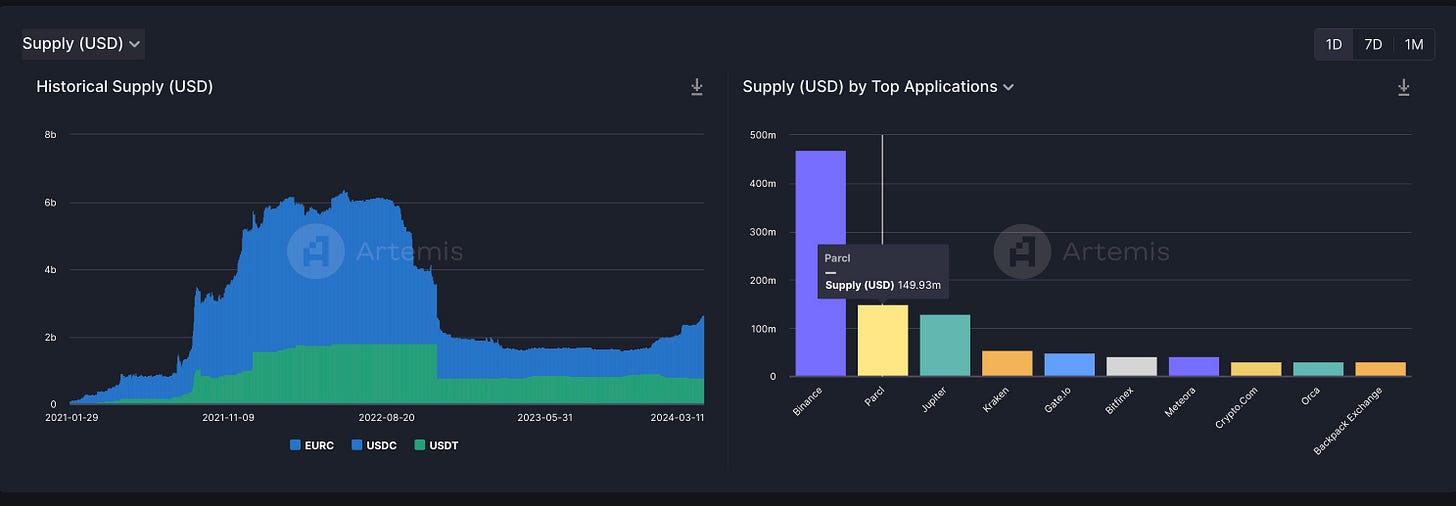

Most of Solana's stablecoin transfer volume (~87%) in the last 24 hours is driven by Phoenix (On-chain DEX) and an MEV Bot. On the supply side, we’ve seen ~$150m of USDC flow into Parcl (real-estate perp)

Solana transfer volumes have continued to grow in 2024.

As we discussed in our initial post on stablecoins, we found that Phoenix, a fully-on-chain DEX central limit order book, represented a large amount of stablecoin transfer volume back in Dec ‘23.

As of March 12th, 2024, Phoenix accounted for $11.2b of transfer volume in the last 24 hours. A member of Ellipsis Labs, which is a core developer of Phoenix, mentions that a market maker was sending USDC in and out of Phoenix rapidly in early January 2024 and that “Transfer volume is not a good indicator of USDC economic activity since it can be smurfed cheaply due to Solana's low transaction fees.”

It’s an important reminder not to focus on just one metric for stablecoin activity (e.g., transfer volume) but to filter and figure out exactly what dapps / smart contracts are driving activity and look at other metrics to gauge stablecoin activity

On the Solana stablecoin supply side, we see that Parcl (real estate perp) saw an inflow of $150m of USDC as the #2 app in stablecoin supply in the last day which we found interesting since it’s not a CEX or typical spot DEX.

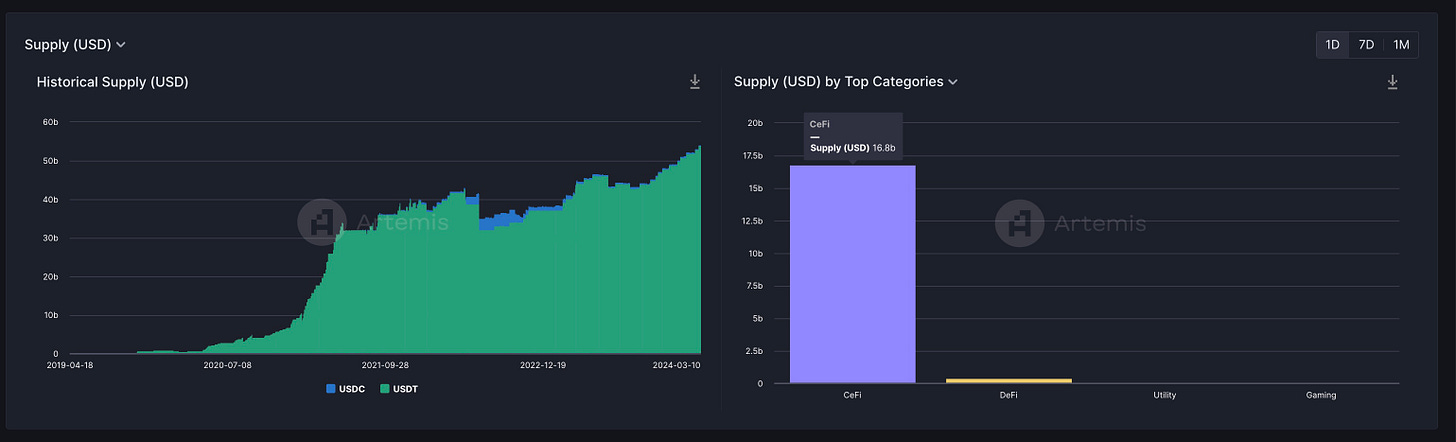

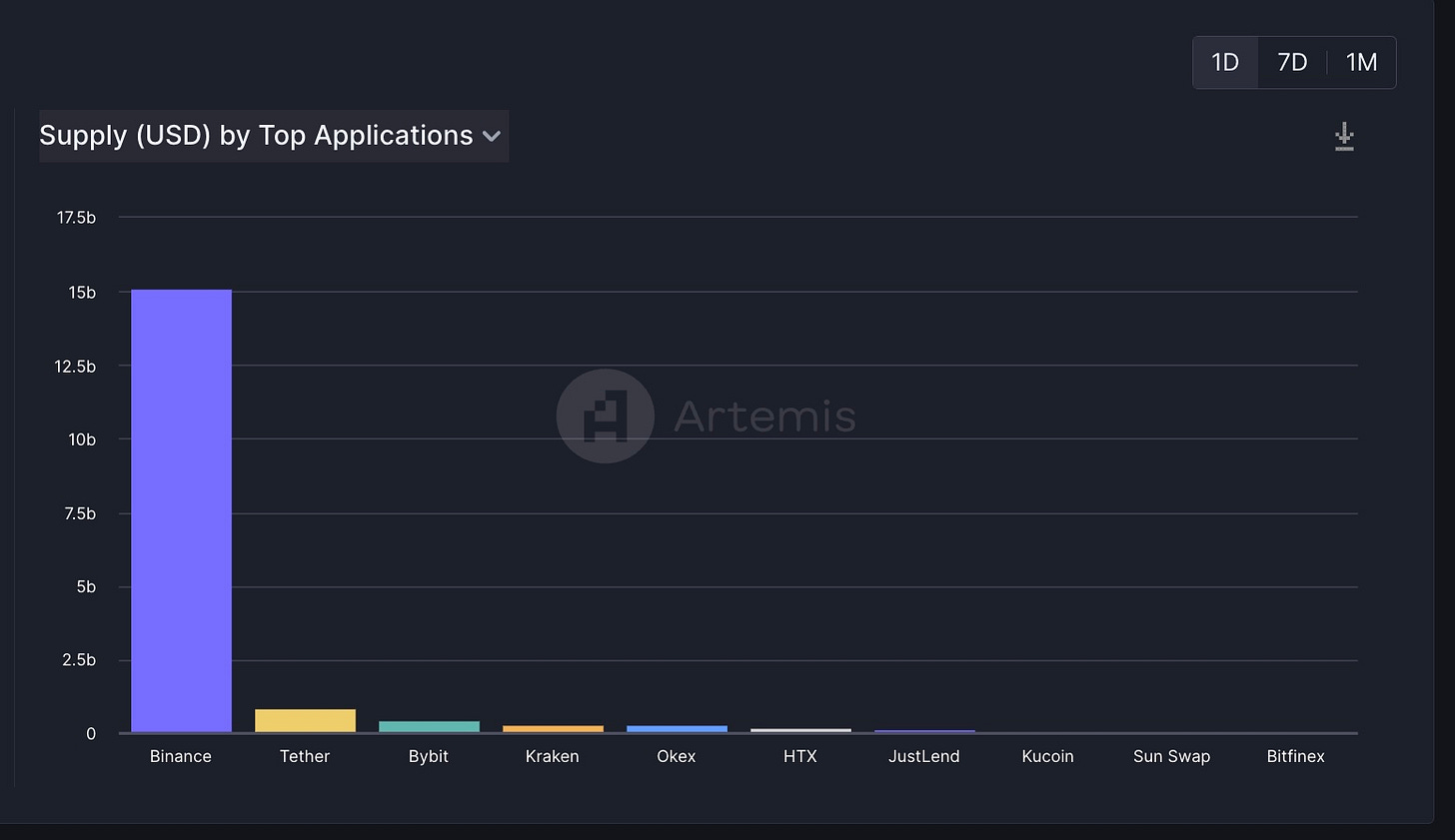

Most of Tron stablecoin supply sits on Binance and other CEXs like Bybit, Okex, Kraken.

On Ethereum where most of stablecoin supply sits in Gnosis Safe, Layer 2s like Arbitrum, or DeFi like MakerDAO, most of Tron USDT sits in CeFi specifically mostly Binance ($15b) followed by Bybit, Kraken and Okex.

Stablecoin supply is growing at ~$150B up 20% since Nov ‘23 but not yet at its ATH of ~$180B in April ‘22 pre Luna crash.

While stablecoin supply has grown in the last 4 months, total stablecoin supply is still ~$30b off of its ATH of ~$180B in April ‘22.

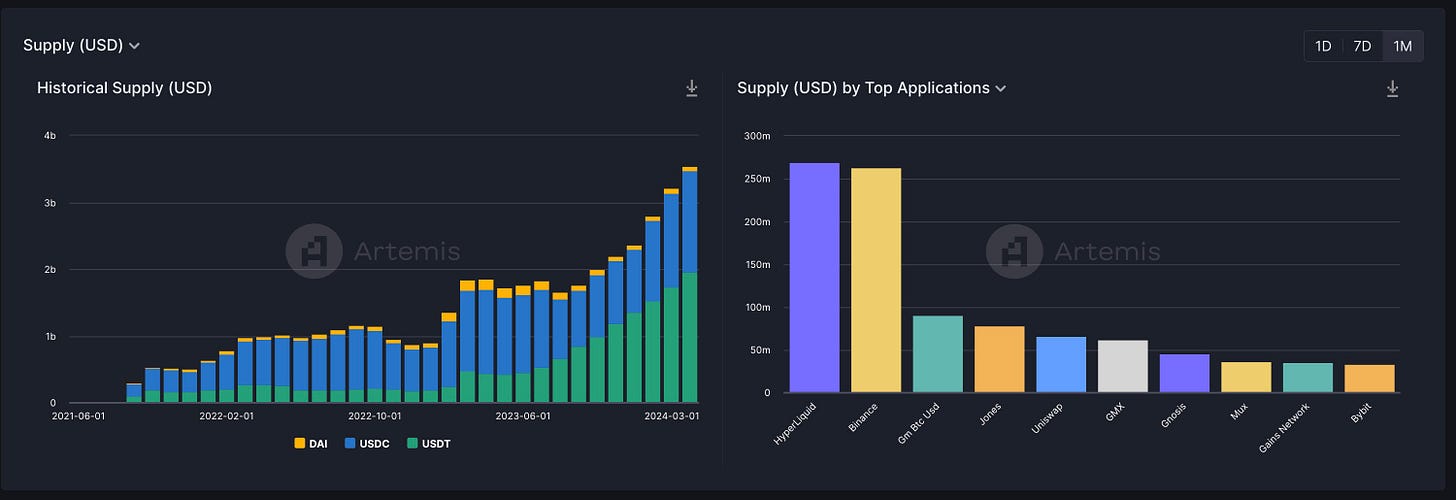

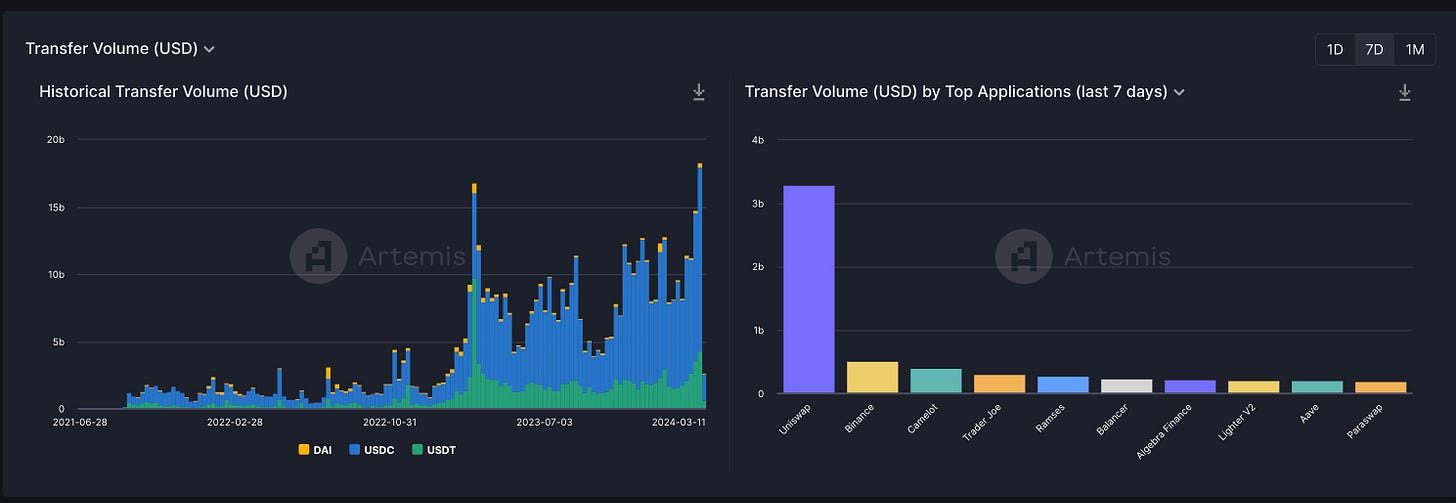

Arbitrum stablecoin supply and transfer volumes are both up in the last 3 months

Arbitrum stablecoin supply is ~$3.2b growing 35% in the last 3 months driven by Hyperliquid (Perp DEX) and Binance (CEX).

Arbitrum transfer volume is also up at $18B, growing 64% in last 3 months driven by Uniswap (Spot DEX) and also followed again by Binance.

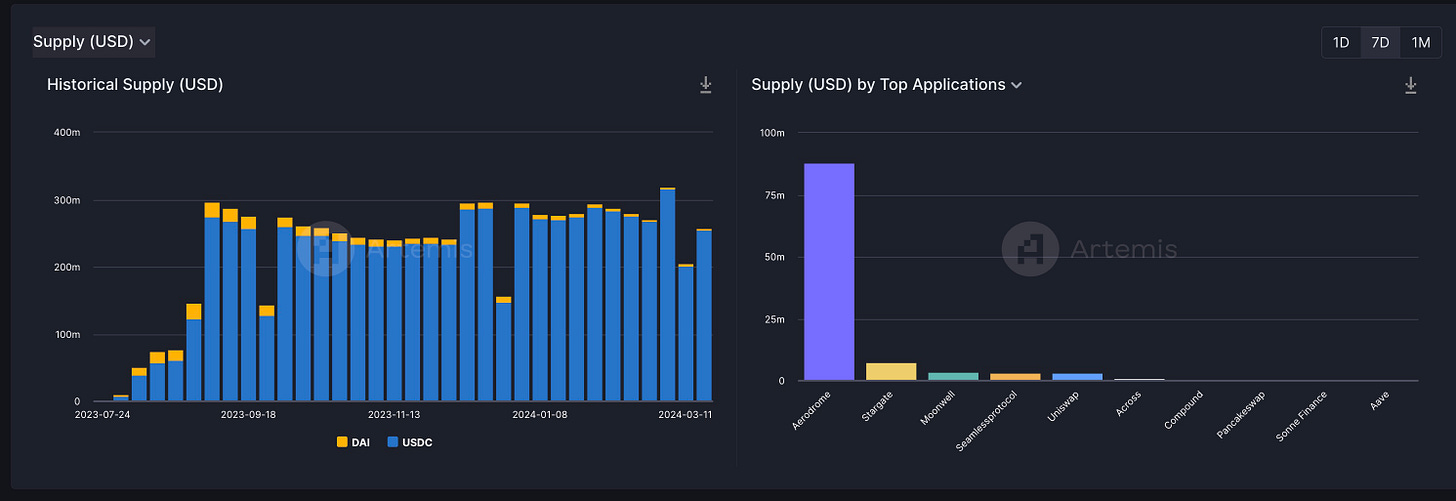

On BASE, Aerodome drives #1 in stablecoin supply, #2 in transfer volume, #2 in number of transfers, and #2 in active addresses.

Aerodome, a DEX on Base, takes top positions across fundamental metrics and even the top position for stablecoin supply on Base. This is surprising, given the dominance of Uniswap on most other chains.

Did you find any interesting insights on the stablecoin activity breakdown? Let us know, or drop us a note! We’d love to hear from you.

Artemis Disclaimer: The authors, affiliates, or stakeholders of Artemis may hold interests in the tokens or protocols mentioned in this content. This disclosure highlights potential conflicts of interest and is not an endorsement to buy or invest in any specific token or protocol. The content is for educational and informational purposes only and should not be construed as investment advice in any form.

Readers should approach this information cautiously and consider their unique circumstances before making investment decisions. The views and opinions expressed are subject to change without notice, and Artemis bears no liability for any loss or damage arising from the use of this information.

Very helpful